Asset Allocation depends on Risk Tolerance

Risk Tolerance and Asset Allocation are tied at the hip and depend on age and recency bias.

How you understand risk—and how you balance the stock/bond proportion in your portfolio—is the most important decision an investor makes.

How has the market been doing lately? During a bull run, people can take all the risk in the world.

During market crashes, however, some people believe the economy is done and on its way to zero. They do the worst thing—sell low and lock in the paper losses—all because their asset allocation was inappropriate for their age and risk tolerance.

This is why risk tolerance is important. It allows you to set an asset allocation and not sell low. You can sleep at night even though the world is falling around you. And remember, asset allocation is set by how you feel in the bad times, not in the good.

Let’s start with this question: what is risk tolerance?

What is Risk Tolerance?

Risk tolerance is not set for an average stock market day; it is set for the worst!

The worst day causes the cardinal sin in investing: selling low and locking in losses.

So, what is risk tolerance? Reverse engineering: it is the asset allocation that meets your goals by age yet lets you sleep at night.

Of course, it is more complex than that and depends on your current environment.

Risk Tolerance Changes Depending on Market Conditions

During a long period of great market returns—folks have high risk tolerance. When the market crashes, it turns out that their ability to tolerate stock volatility isn’t quite up to snuff.

Recency bias is alive and well.

When stocks have done well, we are comfortable with them. Is it possible that your risk tolerance is too high due to recency bias?

But when stocks crash…

Risk Tolerance Depends on Past History

How did you respond last time there was a crash? Did you sell stocks? Or buy?

If you didn’t invest ten years ago, consider that you might feel differently about your investments when the sky falls and your investments are cut in half!

It is important to remember that the market will crash. Stocks regularly go down by 20% or even 40-50%. Regular business cycles create corrections or worse. Larger credit cycles and irrational exuberance create bubbles and recessions.

Risk Tolerance depends on Age

Asset allocation depends on risk tolerance and age. As you age, stocks become more risky! More on this below.

Read that again! People think stocks are less risky the longer you hold them- think again!

Because of sequence of returns risk, it might be appropriate to become more conservative as you age.

Moreover, target date funds may be too risky or, more commonly, not risky enough to meet your goals. Consider your ideal pre-retirement glidepath, and de-risk before retirement.

So, what is your ideal asset allocation by age and risk tolerance? Well…

How bad can it get?

How Bad Can It Get?

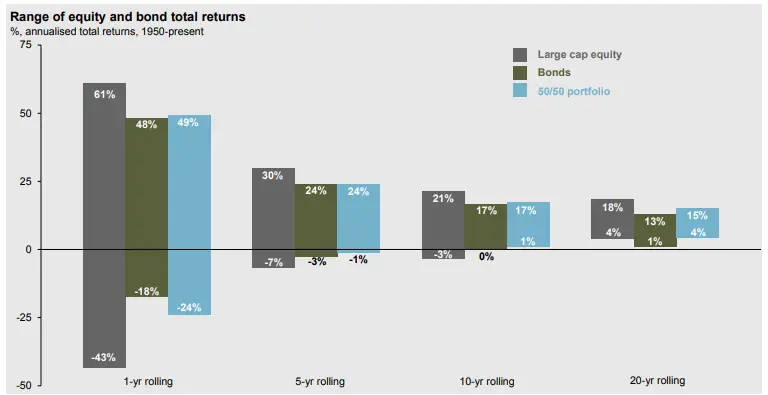

Figure 1 (Risk Tolerance and Asset Allocation and the worst average outcomes)

Let’s see how bad it can get. This might help you with your asset allocation by age and risk tolerance.

Above, you have yearly, 5, 10, and 20-year average returns for 100% stocks, 100% bonds, and a 50/50 asset allocation.

Note the one-year returns. A 100% stock allocation can have breathtaking lows. Down 43%!

Even a 50/50 asset allocation can lose out big time! Down 24%.

Moreover, even during five and 10-year periods, a 100% stock allocation can be down.

Finally, note the average rolling outcomes at 20 years. Are you impressed with how much better 100% stocks did vs. 50/50? 18% vs 15%? Is that smaller than you might have thought?

What does this have to do with tolerance? Above, consider how bad things can get in one year and how, on average, all asset allocations do over 20 years. How much risk can you tolerate?

Now—importantly—how much risk do you need?

How Much Risk Do You Need to Reach Your Goals?

Understand your goals. Understand risk tolerance and asset allocation.

Perhaps a good goal is enough to be financially independent. How much do you need?

What a complicated question! The rule of 25 is a good start. It is based upon the 4% Safe Withdrawal Rate rule of thumb. Of course, in reality, it is much more complicated than that. Social security? Reverse Mortgage? What is your Retirement Income Plan? Will you Bucket or Floor?

The concept is important here. Whatever the number, try to understand your goal and how the average returns will help you reach it. You need to take risks only if you need to take risks to reach your goals!

Take what you currently have and what you plan to add, and multiply by the average return over time to figure out your nest egg in the future. A financial calculator helps.

What are Average Returns?

What are the average returns over time?

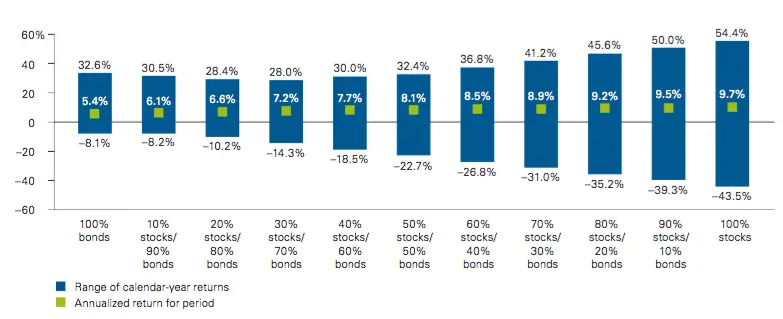

Figure 2 (Range and average annualized calendar year returns)

Note 100% bonds on the left to 100% stocks on the right. Here, we can see the range of yearly returns based on the blue bars in more detail.

The green squares in the blue bars demonstrate the annualized (average) returns, which range from 5.4% for 100% bonds to 9.7% for 100% stocks.

Look more closely at 50/50 right in the middle. The average there is 8.1%. And 70/30? An 8.9% average return is not too shabby.

Average returns are important. If you don’t need to take as much risk to reach your goals, that is, if a safer asset allocation will allow you to reach your goals with less chance of selling low when the sky falls, why take the risk?

So, What Should My Asset Allocation be Based on My Age and Risk Tolerance?

Good question. If you need to take risk and are willing to take risk, then go for it! If you are young and most of your capital is still potential (your job), there is no reason not to be 100% stocks as long as you understand that the market will go down 30% or more at some point. You must view this as something to celebrate! After all, you are buying on sale! If you think you might panic sell, learn why bonds are important.

As you age, asset allocation becomes more important. No rule of thumb works for everyone (age minus 100, etc) because you have different needs and abilities to take and tolerate risk. Remember that asset allocation is your second most important decision (after deciding to invest first). Understand where to take investment risk and do not chase yield.

When Risk Tolerance doesn’t Equal Asset Allocation

Too often, investment advisors will have you take a risk tolerance questionnaire to check off a box. See the Schwab Risk Tolerance Questionnaire if you are interested in a good example.

But to truly understand risk tolerance, you must do more than fill out a risk questionnaire.

You need to understand that you are allocating for the bad times, not the good. Also, know how much you need: as the saying goes—when you win—quit playing! Or at least dial down the risk.

Risk Tolerance and Asset Allocation

Risk tolerance may take a while to iron out. Think about your asset allocation now. How old are you? How much time do you have left before you need the money? What are your goals? How much risk do you need to take?

Remember, times are good right now. Chances are, you are being too aggressive with your asset allocation due to recency bias. Times have been too good!

Use the above yearly average market returns to feel how much a bear market would hurt you. Multiply your nest egg by the downturn and project how much you would lose. Is it 100k? 500k? More? How does it feel to lose that much money?

Next, understand that you didn’t lose any money. You don’t lose until you sell. Consider your asset allocation by age and risk tolerance, and be okay with how much you will lose (on paper) and how much the downturn will hurt you. Do it now, before you feel it for real.

Risk Tolerance and Asset Allocation are tied at the hips.