Behavioral Investing

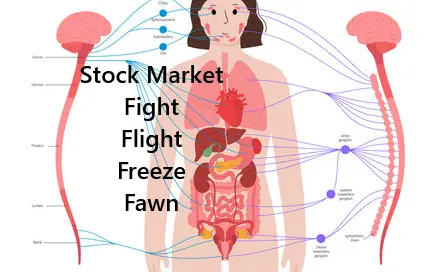

Behavioral Finance and Behavioral Investing Behavioral finance studies how to systematically take advantage of errors caused by human thinking and emotion. Behavioral investing, on the other hand, aims to cash in on the irrational investor. How is behavioral finance different […]