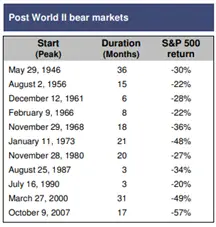

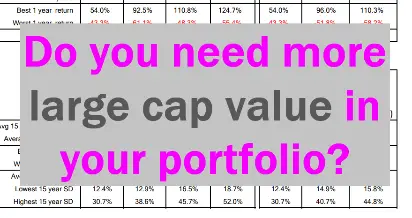

Structured Product as a “Hedge”

Structured Product as a Hedge Are you being sold structured products as a hedge? What is a structured product, and why should you avoid them? Or, if you are convinced that they do in fact offer downside protection, what do […]