What are the Mitigatable Retirement-Specific Risks?

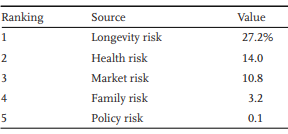

So, what are the mitigatable Retirement-Specific risks?

We have looked a little at which risks are worth mitigating in retirement.

Then there is the how. How do you mitigate those retirement-specific risks.

Next, let’s dive deeply into some of the most intractable mitigatable retirement-specific risks to see what we can learn about possible solutions.

Mitigatable Retirement-Specific Risks

Retirement-Specific Risk #1: Unable to Spend after Decades of Saving

Retirement is all about turning assets into income. So how do you convert your assets into money to spend? This is often backward to the beginner retiree. Wait, I have to spend down my assets? After decades of seeing a net worth increase, it is ok to have a net worth drop. Issues that need consideration: long-term cash flow planning, liquidity, spending shocks, and, especially importantly, moving from the accumulation mindset to a de-accumulation one. The fear of scarcity can be a huge problem when you retire, especially when you retire early. Remember, though, the solution for the fear of scarcity is enough, not abundance.

There can be several problems if you get stuck in the accumulation mode. Not only do you worry about spending down your assets appropriately, but you can also ignore hedging your bets and covering the other risks out there.

So let’s next talk about the three major risks you face in retirement.

Sequence of Returns Risk

Sequence of Returns Risk may be the largest challenge soon-to-be retirees face. This is because it happens only around the time of retirement. Sequence risk, however, is also easy to plan for!

The last thing you ever want to do is sell your assets when they are low, and I call this the cardinal rule of investing: don’t sell low!

You might be forced to sell low if you retire and the market tanks. This poor sequence of market returns can then plague the rest of your retirement.

Most people don’t retire into a poor sequence, but you must plan as if you will! (after all, I retired into the teeth of sequence of returns risk!) Of course, if you don’t, you will be better off than you prepared for the rest of your retirement, but that is better than the alternative!

Longevity

Longevity is better than the alternative! Some say longevity is the only risk, as all other risks are exacerbated by time. However, longevity is the great multiplier of all other risks. Almost any retirement plan will work out ok if you die shortly after retirement.

But it would be best if you planned to live a long life. And aside from financial issues that are exacerbated by time, there are cognitive and health issues to consider.

Inflation

Inflation may be a sleeping dragon. Delaying social security until you are 70 and having adequate exposure to equities in the stock market are obvious solutions. But remember what food used to cost you 20 years ago, and remember prices will at least double during your retirement.

There are also inflation-linked fixed securities to consider in your tax-sheltered accounts, and most retirees should consider devoting a portion of their assets to these. There is even sequence of inflation risk to consider!

Unfortunately, there are no perfect solutions to the problems caused by inflation. Insurance companies sell some inflation-linked products, but you will often find these too expensive to be worth your time. Insurance companies like to understand exactly what risks they are assuming, and no one can predict what inflation will be in the future!

I deal with inflation during the chapter on longevity. After all, inflation is negative, compounding on your spending ability, and it is only a problem if you live a long life!

Mitigation of Other Retirement Risks

Asset Allocation

Portfolio risk and asset allocation are important considerations. You must invest your assets wisely and be diversified. Understand your risk tolerance and why asset allocation is important to prevent the one cardinal sin of investing: selling low and locking in losses. The wise pre-retiree wants to be de-risked by about five years before retirement. A total market return mindset is important, as are fixed-income and fixed income alternatives. You must be invested appropriately to hedge for the many possible futures.

Taxes in Retirement

Taxes are the largest expense in retirement. Therefore, tax efficiency, tax diversification, and future tax rate policy risk are important considerations at the very base of a comprehensive retirement plan. In addition, partial Roth conversions will be an important consideration for many as a mitigation strategy, as taxes are the only retirement expense you can truly pre-pay.

Illness and Wealth

Health is truly important in all phases of life, but even more so in retirement. When you slow down a bit, you might have a little more time on your hands to improve your health. An exercise and diet plan is as important as anything else in retirement!

Insurance, such as Medicare, supplemental insurance, and Long-Term Care Insurance, will challenge you intellectually, as they are among the most difficult considerations in retirement. You can be sure your spending on healthcare will increase in the last few years of a long retirement, so balancing reserves with current spending is important.

Spousal Issues

No one wants to talk about grey divorce or death of their spouse. Emotions run high in these discussions, but it is important to consider the loss of your spouse. Expenses don’t go down by 50% when there is a loss, but income almost certainly drops at least by the amount of the smaller social security payment.

If you are married, you need to run your retirement plan two more times, one each considering what would happen if a spouse dies early. Of course, this will not deal with the emotional impact of such a tragic event, but the last thing you want to worry about when a spouse dies early is money.

What are Retirement Risks Just Scare Tactics?

There are a few risks that I do not consider worthy of planning for. Which risks are Scare Tactics?

There are a lot of people out there who make money off you. This is the service industry that is the engine behind the American economy.

While we don’t expect services for free, one does need to worry about being taken advantage of. Especially when dealing with money or products designed for retirement. After all, how easy is it to skim off a percent here and a commission there when considering money. You don’t need to be an expert in all things finance, but you do need to understand how a provider of service is being paid. Equally as important, you must understand incentives. There is a great saying by Upton Sinclair which is important to remember: “It is difficult to get a man to understand something when his salary depends on his not understanding it.”

Which risks are scare tactics?

Market Volatility

A great example is market volatility. If you watch the financial news media, you would think that a one-day sharp decline in the market is a national tragedy. Unfortunately, a sharp drop in stock prices either in a day or over several months is just the cost of admission for investing. It is to be expected!

Wall Street uses the “risk of market loss” as a strategy intended to manipulate you into fear. On the contrary, volatility is why we invest in the stock market. It is what brings a risk premium for stocks over bonds!

Social Security Risk

This is a big one! Financial pundits use the fear of social security loss to get your eyeballs and attention.

Social security will not go broke, but there could be a reduction in benefits. Remember, however, that benefits have been reduced in the past by increasing the retirement age and by increasing taxation of social security. And these changes are phased in, so they just affect people who have some time to adjust to them.

If you truly need social security to survive retirement, chances are there will be no cuts to your monthly check. This is especially true if you are close to claiming.

On the other hand, if you have other assets, it is almost certain that the taxation of social security will increase. You paid in more during your working years, and you get less in retirement. This is not a risk because you just need to assume it will be true. If you have other assets, it still pays to wait as long as you can to claim social security and just deal with the reduction in benefits. Plan for it to happen, and be pleasantly surprised if it doesn’t.

Summary- What are the Mitigatable Retirement-Specific Risks?

In essence, the choice is binary: there is insurance (risk pooling), where you pay premiums for a third party (insurance company) to share the risk with you, or you can decide to self-fund the risk.

But nothing is every truly binary!

Somewhere in the middle, there are products designed to mitigate specific parts or components of risk. These can either be income-based products (good annuities intended to provide a “personal pension”), or products with a contractual guarantee of participation in the stock market.

On the far other side of the middle, (or the square, if you use the RISA), you have the probability-based folks. Instead of insurance, they use the risk premium from the stock market and asset allocation to tune risk-reward for future retirement risks.

But take a step back, and you see human capital, other assets (such as real estate and additional cash-flowing assets), and other personal sources of income (for instance, pensions and social security claiming decisions) greatly affect your need and ability to mitigate any specific retirement risk.

The risks are there for you to choose to mitigate or not.