Safe Withdrawal Rate Early Retirement

Early retirement requires a lower Safe Withdrawal Rate.

Not only is the future uncertain, but there is also a longer future when you retire early!

Also, it is more difficult to study the Safe Withdrawal Rate over a long retirement as there are fewer historical 60-year periods to review than 30-year periods.

Consider a 4% Safe Withdrawal Rate in early retirement and see what modifications we might make. What is the safe withdrawal rate by age?

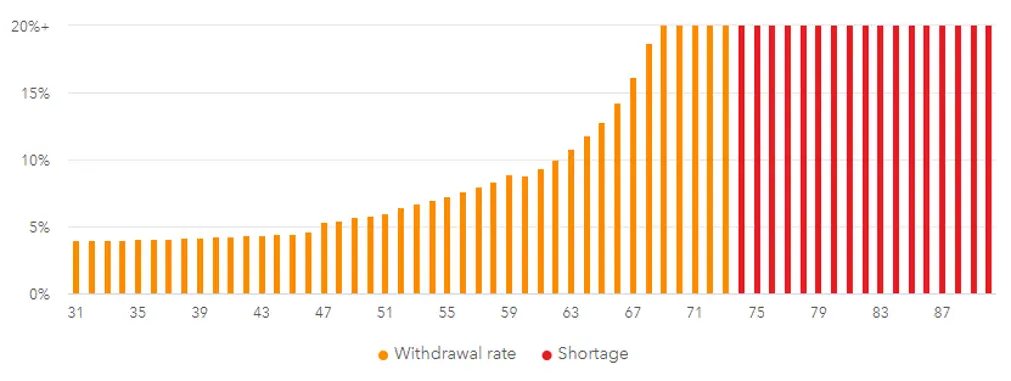

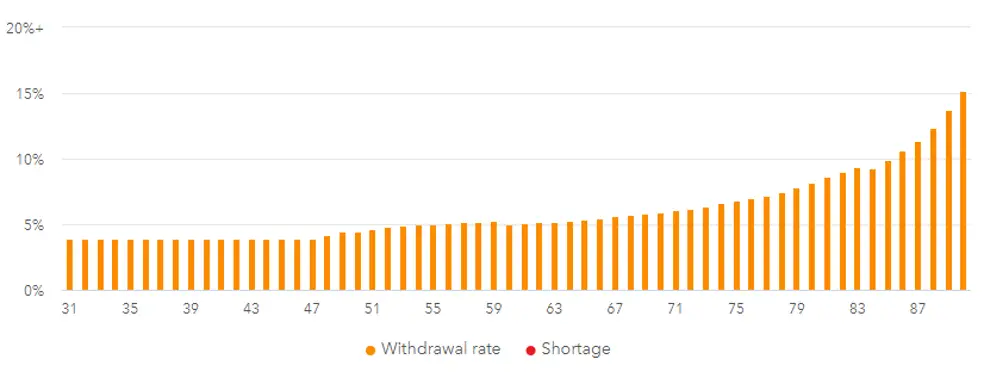

60/40 Portfolio with a 4% Safe Withdrawal Rate

Figure 1 (60/40 Portfolio with a 4% Safe Withdrawal Rate)

In Figure 1, you retire early at 30 with a $1M portfolio. You withdraw 4% a year and run out of money after 50 years! The safe withdrawal rate depends on your age.

This portfolio is invested in a typical three-fund portfolio with half the money in tax-deferred accounts and good asset location.

Of course, assumptions are everything when dealing with historical modeling. The Trinity Study and Bengen’s 4% rule use historical data. Above, I use conservative estimates of future returns based on recent Vanguard projections.

Class Assumed Returns

International Equities 8.5%

US Equities 5%

US Bonds 3.5%

Source: Infographic

What about if we use the same 60/40 portfolio with a 3.25% Safe Withdrawal Rate?

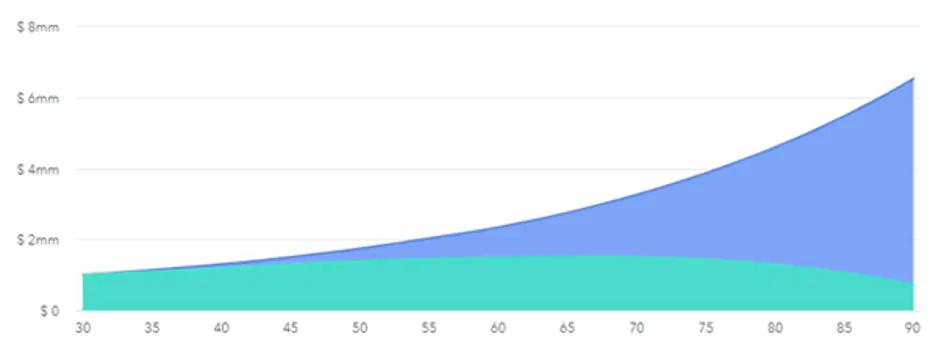

60/40 Portfolio with 3.25% Safe Withdrawal Rate

Figure 2 (60/40 Portfolio with 3.25% Safe Withdrawal Rate)

Here, you can see the lower Safe Withdrawal Rate during early retirement makes it to the end! There is a bump around the age of 50 when the brokerage account expires, and you have to withdraw just from the pre-tax accounts.

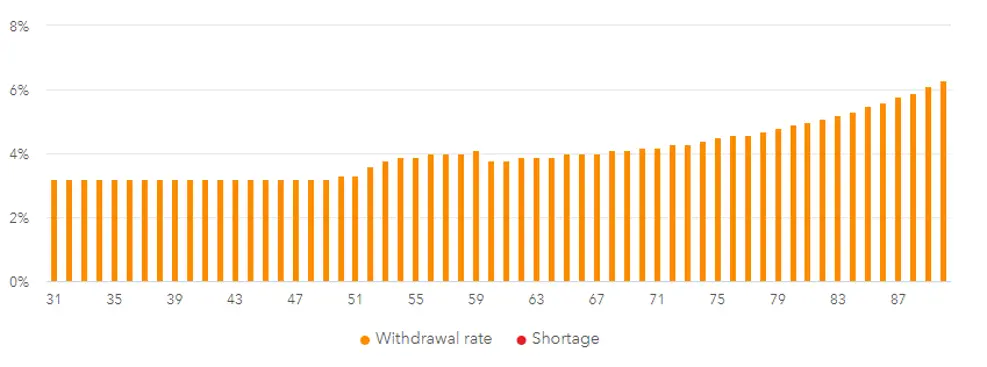

Let’s compare these two different scenarios and see what is left at the end.

Figure 3 (Portfolio remaining after early retirement)

Now, you can see the remaining portfolio after early retirement. In blue, the 3.25% Safe Withdrawal Rate grows slowly over time, whereas the 4% Safe Withdrawal Rate is decimated.

What if you used a more aggressive asset allocation in early retirement?

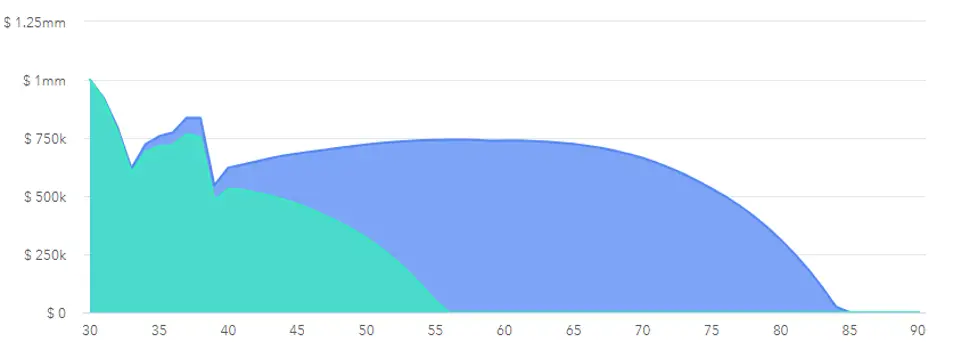

Aggressive Asset Allocation and the Safe Withdrawal Rate

Early retirement means your money has to last a long time! What if you used a more aggressive asset allocation than 60/40?

Figure 4 (90/10 Portfolio with a 4% Safe Withdrawal Rate)

That’s more like it! With a more aggressive 90/10 portfolio, the 4% Safe Withdrawal Rate makes it to the end! Compare Figure 4 with Figure 2. It takes more than 50 years of inflation to affect the withdrawal percentage. Note that it slowly creeps up over time and will expire after 60 years of early retirement.

How much is left at the end?

Figure 5 (90/10 portfolio with different Safe Withdrawal Rates)

Above, you can see in green that 4% make it to retirement with the more aggressive 90/10 portfolio. With the lower 3.25% Safe Withdrawal Rate in blue, the remaining portfolio increases over time!

What is the Safe Withdrawal Rate in Early Retirement?

What is the Safe Withdrawal Rate in Early Retirement?

So, given lower assumed future returns than historical averages, the Safe Withdrawal Rate depends on your age and the initial asset allocation. You can see from the above examples that 3.25% is ok regardless of the asset allocation. Compare that to a 4% Safe Withdrawal Rate that just barely squeaks by if you go aggressive—90/10 asset allocation.

What is the downside of going aggressive with your asset allocation? Hello, Sequence of Returns Risk.

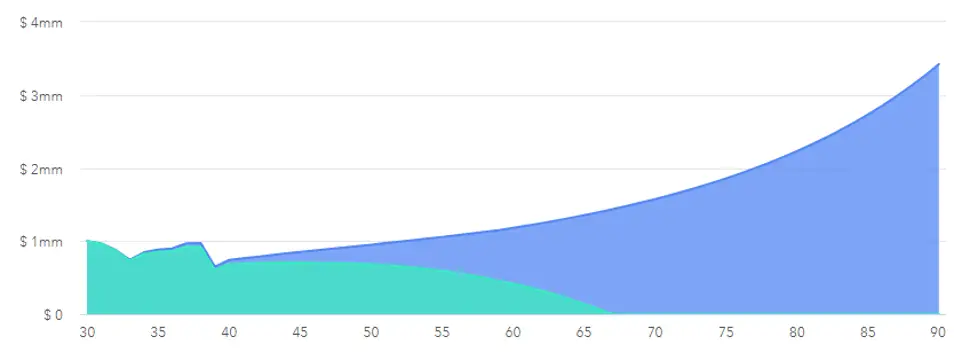

Sequence of Returns Risk and Early Retirement

Sequence of Returns Risk is perhaps the largest risk early retirement folks face.

If there is a bad sequence of market returns when you withdraw funds from your equities, you are at a higher risk of running out of money! This is especially true when your portfolio has more equities to bonds. Bonds serve as a buffer to draw from when equities are down.

Figure 6 (90/10 Portfolio exposed to Sequence of Return Risk in early retirement)

Above, you can see what Sequence of Return Risk does to an aggressive portfolio.

Here, the 4% Safe Withdrawal Rate in green is decimated by Sequence Risk. It expires after 25 years. Even the “safe” 3.25% Safe Withdrawal Rate in blue doesn’t survive Sequence of Return Risk if the portfolio is aggressive!

Sequence Risk is simulated in this situation by the actual market returns from 2000 to 2010. So, if Sequence of Return Risk is a problem for those thinking about early retirement, and history is any guide, what is one to do?

What about Rising Equity Glidepaths?

Can a Rising Equity Glidepath (REG) Save a 3.25% Safe Withdrawal Rate in Early Retirement?

Let’s look at a REG and see if it can save you in early retirement.

It starts conservatively to prevent Sequence of Return Risk. Then, gradually increase the equity portion of your asset allocation over time. For example, let’s start at 60/40 and increase to 90/10 over ten years.

Figure 7 (A REG and Safe Withdrawal Rate in Early Retirement)

Above, you can see the effect of Sequence of Return Risk even with a REG. The 4% Safe Withdrawal Rate in green does not survive Sequence of Return Risk even with a REG. In blue, the 3.25% Safe Withdrawal Rate has a very different slope now that we have added an RSG. Look at the blue in Figure 6 with a 90/10 portfolio and Figure 7 with a 60/40 portfolio and a REG that takes the asset allocation to 90/10 over ten years.

Summary of Safe Withdrawal Rate in a Prolonged Retirement

What did we learn? Early retirement means you have to be careful with your Safe Withdrawal Rate! A 4% Safe Withdrawal Rate does not make it in early retirement unless you have an aggressive asset allocation.

If you have an aggressive asset allocation in early retirement, you are subject to Sequence of Returns Risk!

Even a Rising Equity Glidepath, where you are conservative early on and become more aggressive after Sequence Risk has passed, doesn’t rescue a 4% Safe Withdrawal Rate in Early Retirement.

So, what is the Safe Withdrawal Rate in a prolonged retirement? It is not 4%. Longevity is a risk we must all consider before retirement.