The 4% Safe Withdrawal Rate in Action

The 4% Safe Withdrawal Rate is back-of-the-envelope retirement planning.

It is heavily talked about (and unnecessarily debated), so let’s see what it looks like in action!

The 4% Basics

Assume you have $1 million and 30 years left to spend it. A Three-Fund Portfolio sounds good, and you select a 60/40 stock/bond asset allocation. You have $400,000 in a brokerage account, $400,000 in a 401k, and a Roth IRA worth $100,000.

As for asset location:

- Brokerage: $100,000 in total US, $200,000 total International

- 401k: $200,000 in US Stock and $400,000 in US Bonds

- Roth $100,000 in US Stock

Let’s subtract 4% in the first year, adjust for inflation, and see how we do over time!

The 4% Rule with a Moderate Portfolio

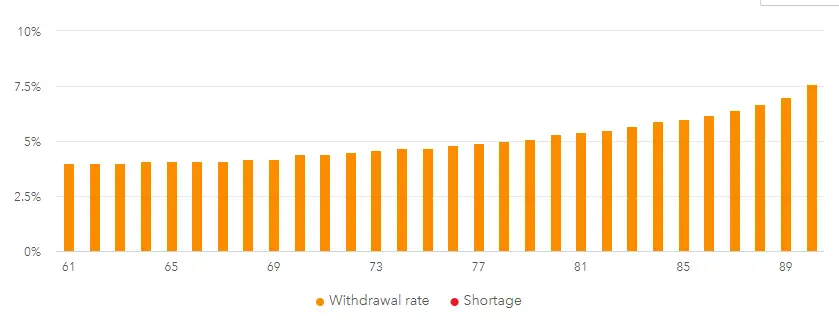

Figure 1 (60/40 portfolio and the 4% Rule)

Figure 1 demonstrates the 4% Rule from a moderate 60/40 portfolio over time. You start taking $40,000 the first year and increase that dollar amount by inflation each year. Since inflation is assumed to be 2% in this scenario during the second year, you would take out $40,800, and so on.

Note that although you start at 4% because your portfolio has investment returns, the withdrawal percentage slowly increases. At year 30, the maximum withdrawal rate is about 7.5% of your portfolio a year.

What if you changed your asset allocation to a much more aggressive 90/10 asset allocation?

The 4% Rule with an Aggressive Portfolio

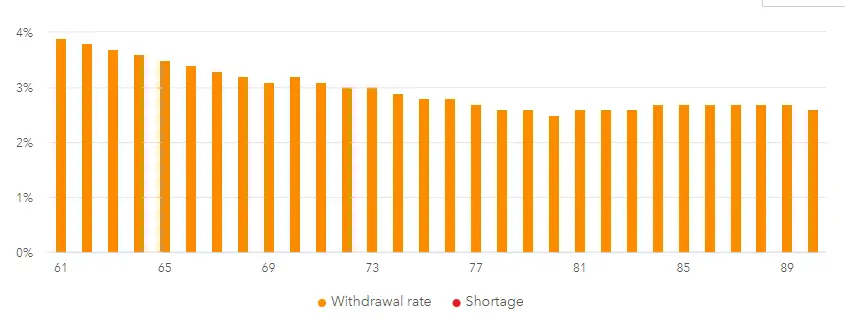

Figure 2 (90/10 portfolio and the 4% Rule)

In Figure 2, note how the withdrawal percentage decreases over time as your 90/10 portfolio earns more than you take out each year. This is despite inflation and the 2% increase in the dollar amount you withdraw yearly. For the withdrawal percentage to decrease, you must make more in your portfolio than you are taking out.

How much will your portfolio grow each year? Well, to know that, you need a crystal ball.

Assumptions of Future Returns

Instead of a crystal ball, let’s assume the following assumptions for 10-year returns: US equities 4-6%, US bonds 2.5-4.5%, and International equities 7.5-9.5%. (This is based upon Vanguard’s return assumptions for 2020, which are just for fun).

To keep things simple in this example, we will use 5%, 3.5%, and 8.5% returns, respectively.

Comparison of the 90/10 and 60/40 Portfolios

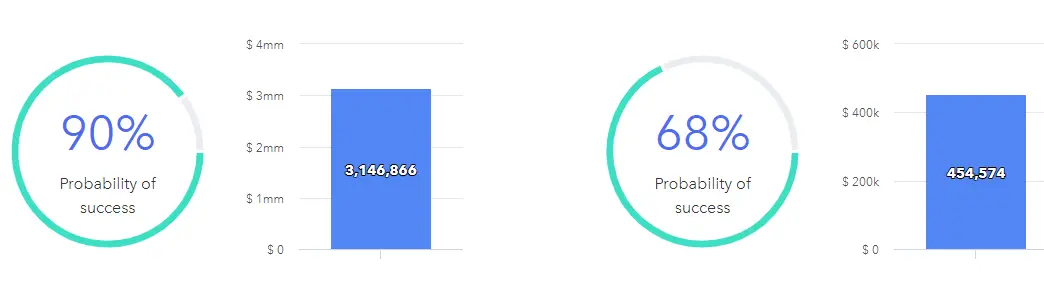

Figure 3 (90/10 and 60/40 portfolio comparison)

Above, we see the Monte Carlo success percentages and final balances of the 90/10 (left) and 60/40 (right) portfolios. Given the return assumptions from above, the chance of success is 90% for the more aggressive portfolio compared to 68% for the balanced portfolio. There is also much more money left after 30 years (blue bars).

So why would you ever use a less aggressive portfolio? The answer is Sequence of Return Risk.

Sequence of Return Risk and the 4% Rule

When you are drawing down on your portfolio, negative stock market returns cause you to reverse the dollar cost average. This rapid initial depletion can cause long-term failure after just a few negative years. Sequence of Return Risk (SORR) describes the failure of your portfolio determined by the returns before and after you start withdrawing.

How does SORR affect a 90/10 portfolio?

SORR and an Aggressive Portfolio

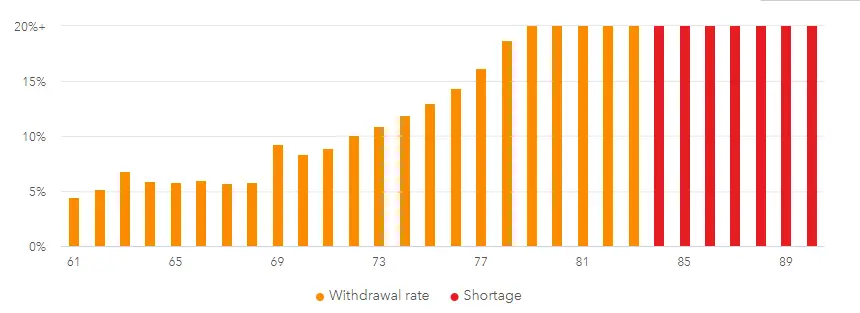

Figure 4 (90/10 portfolio with Sequence of Return Risk)

Figure 4 shows the same 90/10 portfolio we saw above, and we are only using the actual returns from 2000-2010 instead of the assumed returns. As you can see, the withdrawal percentage rapidly increases to unsustainable levels, and the portfolio runs out of money at age 84.

Let’s compare the drawdown of the 90/10 and 60/40 portfolios using the actual returns from 2000-2010.

Drawdown Comparison

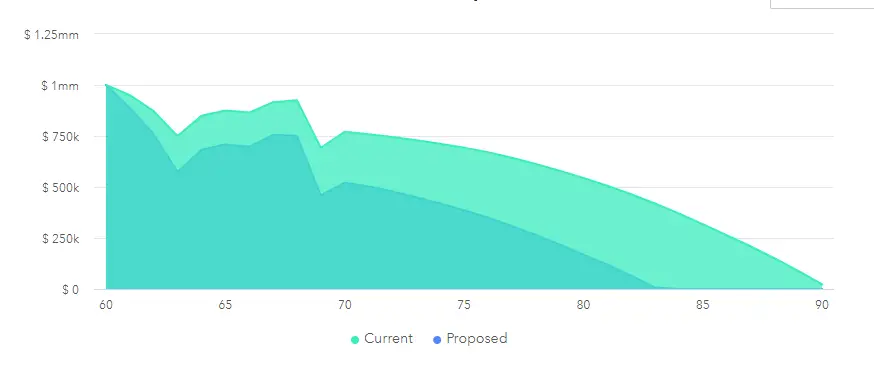

Figure 5 (Drawdown comparison with Sequence of Return Risk)

Above, we can see the 90/10 portfolio in dark green and the 60/40 portfolio in light green. With the more aggressive portfolio, we see large losses during the negative years, which are not made up for during the positive years. The aggressive portfolio runs out, whereas the moderate portfolio makes it to the end of the plan.

So, in summary, you do well to be more aggressively invested unless you suffer from Sequence of Return Risk. That is the dilemma of the 4% Rule.

The 4% Rule Revisited

So, what is a retiree supposed to do? With low expected equity returns and bond yields… does a 4% Rule still work?

If you plan on a traditional retirement, the 4% Rule is safe if you take sequence of return risk into account in your asset allocation. Use a moderate portfolio five years before to 10 years after your retirement. That is, Go Conservative to prevent Sequence of Return Risk! You can take more risk with an aggressive portfolio before and after when you are most susceptible to SORR. When your risk has passed, you may consider a bond tent or rising equity glidepath.

I will leave you with the following thoughts:

- US recent historical returns are considerably better than other countries’ returns

- 30 years is the general limit of the 4% rule, but if you avoid sequence of returns risk the portfolio lasts forever

- The 4% Rule ignores social security and other income sources

- William Bengen’s original research used a 50/50 portfolio with 5-year treasury bonds

- The Trinity Study used higher volatility corporate bonds rather than treasury bonds

- 4% is only used the first year to get the withdrawal dollar amount

- Subsequent years, the dollar amount is increased by the Consumer Price Index (CPI)

So, when it is time to retire, will you use the 4% Rule? It’s probably a good place to start, but flexibility is the key.

It all depends on your returns in the first couple of retirement years.