Structured Product as a Hedge

Are you being sold structured products as a hedge?

What is a structured product, and why should you avoid them? Or, if you are convinced that they do offer downside protection, what do you need to understand before investing? Is having a Fixed Indexed Annuity (or a RILA) better if you are looking for downside protection? What about a buffered ETF?

Let’s deeply dive into the complex world of structured products and try not to drown. Do they act as a hedge? Do you need a structured product?

Complexity

Structured products are some of the most complex products out there. By definition, you—the individual investor—will not thrive in a world of such complexity.

Fees and complexity do not favor the individual investor: Occam and his razor.

That said, folks worry about market volatility and are interested in “downside” protection. Others, closer to retirement, look to take risk off the table. Structured products profess “no losses” yet the ability to “participate in the upside.” What gives? Is the complexity worth the hedge?

What are Structured Products?

There are many different types of structured products. So, what are structured products? Let’s look at a simple version meant to eliminate downside risk yet offer higher returns than other fixed-income products.

That, fundamentally, is the goal of these products: to lower both the risk and the reward of investing.

The Basics of a Structured Product?

A structured product is a combination investment that includes fixed income and derivatives. Usually, they are used as a hedge. A Hedge is a position that offsets the risk of some other position. Say you feel that you have a lot of stocks right now. By hedging, you limit the risk in that investment.

Here are the components of a Structured Product:

Fixed Income

Income generated by these investments needs to “guarantee” against losses. These fixed-income products are commonly government bonds (including STRIPS or Zeros), corporate bonds, or CDs.

Derivatives

The income purchases options from the fixed-income investments or the amount above the fixed income need to guarantee no loss. These options expire worthless if the index is flat or goes down, but they pay if the index goes up.

Hedge

The fixed income “floor” ensures you get your money back, and the difference is used for derivatives that increase your return when the index goes up.

Therefore, there is only one upside, and you don’t have a risk of losing your principal. When the underlying index does well, you benefit. If it tanks, your options expire worthless, but you don’t lose any money! (Except expenses are eating away all the while.)

Let’s look closer to see this in action.

Structured Products in Action

Fixed Income

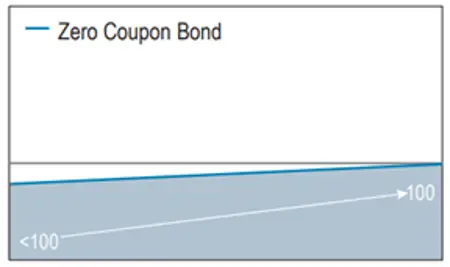

Figure 1 (Fixed Income in Structured Product Investments)

In Figure One, we invest in zero-coupon bonds. Zeros don’t pay income, but over time, they pay you more than you put in. So, for this example, we needed to guarantee 100% of our money back, but only needed to invest 90% of our money to do so. Now, we have a “floor” or a guarantee and can spend that 10% on something else. What do you want to spend it on?

Underlying Option

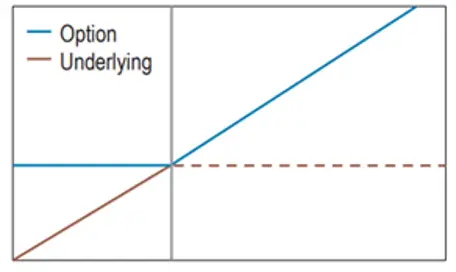

Figure 2 (Underlying option in a Structured Product)

We take that extra, say, 10%, and buy options. Figure 2 shows the possible returns for this option when we buy it at the grey vertical line.

The blue horizontal line represents the left of this line (that is, the market is down). We don’t lose any money because the option expires worthless!

If the market is up (to the right of the gray vertical line), we make money along the blue line.

So with this option, we cannot lose money (more than what it costs us to buy it!), and we have the potential for upside growth.

What happens when you put the two together?

Hedge Products Graph

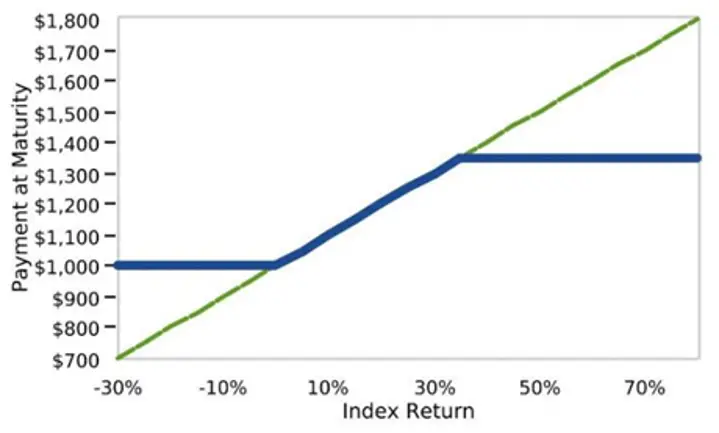

Figure 3 (Graph of Hedge Products)

Now, we can see the payment at maturity on the left and the index’s return on the bottom.

Our returns are in blue again. If the market is at -30% or 0%, we don’t lose any money because we have the Zeros flooring our return, and the options expire worthless. As the market gets positive returns, we make more money!

Eventually, the amount we make reaches its limits as the options top out. This is why there are “caps” and “spreads” on fixed-indexed annuities because the options can only produce a certain amount of income. But we will mention fixed-index annuities later.

Let’s look at another way to visualize structured products because they are tricky to understand.

Visualize Structured Product Hedge Funds

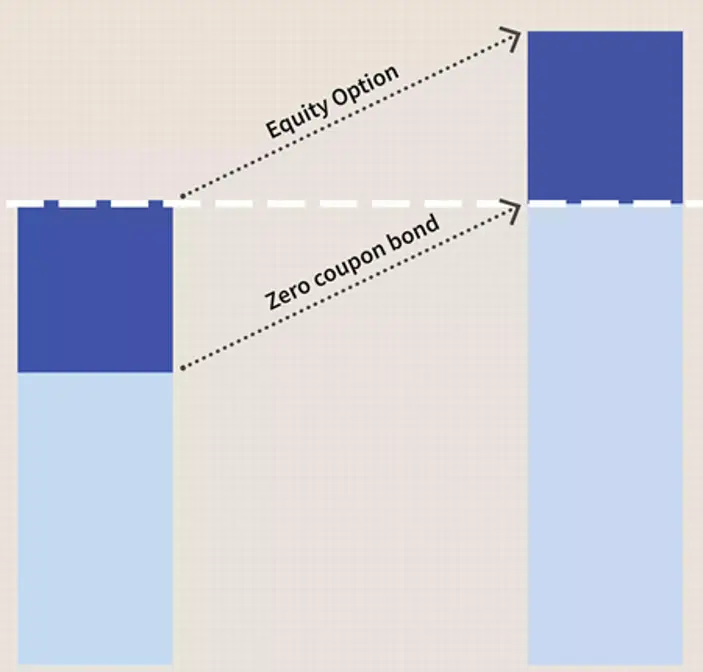

Figure 4 (Another way to visualize structured product hedge funds)

Look at Figure 4 for another way to view structured product hedge funds. Note in light blue, we have CDs or Zeros that, over time, return 100% of our principle investment. So there is no loss!

Then, in dark blue, we have extra money to invest in options. If the market returns positively, the extra money on the left provides the extra returns on our right. If the market returns zero, you don’t get the dark blue bar on the top, but you are still left with 100% of your investment! Minus, of course, expenses for the structured product investment!

Structured product investments are expensive! But before discussing that, let’s talk about Fixed Indexed Annuities.

Fixed Indexed Annuities are Structured Product Hedge Funds

The darling of the annuity world, Fixed (or Equity) Indexed annuities are structured product investments with the additional backing of the insurance company guaranteeing the product.

This additional backing is not free, and FIAs can be even more expensive than structured products.

They are pitched: participate in growth of the index with no downside!

As we see above, they buy fixed income and use the difference to invest in options on indexes, just like structured product investments.

They say that you don’t pay commissions for these products, which is true to a certain extent. If you invest 100k into a FIA, 100k is credited to your account. So, how does the salesman get paid? The insurance company pays them the surrender charge if you leave early, and they make their money up through interest rate changes.

How does that work? Say they get a return of 3% on the fixed-income component of the investment. They only credit you with 1% of that and keep the 2% difference to make money. So, you have less of your money working for you with FIAs than you might with other structured products. In addition, FIAs can have riders that charge you 1-3% of your account value for future opportunities, such as guaranteed withdrawal benefits or Long-Term Care insurance. There are many ways insurance companies make money off your “investment” in these complicated (or even incomprehensible) annuities.

We haven’t even discussed why you don’t need structured products or FIAs as a “hedge” yet.

How Structured Product Hedge Funds are Sold

You might read: For the conservative investor, they present intriguing alternatives to standard asset classes. Yet, they are bonds and options. They are just packaged together for your investing entertainment.

Structured product investments have many different bells and whistles that are not mentioned above. You can leverage these products to provide 2x the growth or have less downside protection (say, it stops losses at -10%).

So, on one hand, they can be sold to the nervous investor to “lock in” their growth. And on the other hand, they can be sold to investors who want to “express” how they feel about the market. You can invest in this structured product if you think it will be sideways. If you think it will mostly go up but have volatility, you’ve got that structured investment.

Folks, we know something that works perfectly well to lock in growth. And it is not a structured product.

Beyond that, we know “expressing” your opinion about what the market will do in the short term is nothing more than a fool monkey throwing darts at the dartboard.

Don’t use market-linked investments—structured products—to express yourself or lock in the downside. There are less expensive and easier ways to hedge. It’s called asset allocation.

What are the risks involved in Structured Product Hedge Funds?

Not Liquid

There is no daily pricing or net asset value; usually, there is a surrender period and charge.

Extremely Complex

We have just scratched the surface with these products. Again, complexity favors the large company rather than the individual investor.

Credit Risk

With low interest rates, some products may have more risky fixed-income products.

Tax Treatment

Complex and may be uncertain. Not infrequently, there is phantom income.

Costs

They are expensive!

Pricing Transparency

Frequently none. You cannot compare these products apples to apples so you never know how one performs compared to another.

Dividends?

There are no dividends. You only own an option on the equities, not the equities themselves. Always remember the return is based upon the index’s price alone and excludes dividends.

Structured Product Investments are Hedge Funds: Why you don’t need one!

So, we now have a pretty good understanding of structured product investments and can decide whether we need one.

Do they act as a hedge? Yes! Do you need a structured product investment to act as a hedge? No!

No, you don’t need a structured product investment. The reason: Money is Fungible.

That’s right! It comes back to the fallacy of mental accounting. You cannot rope off a section of your money and somehow treat it differently. All your investments are part of your asset allocation, even if you pay someone to put in a structured product.

With a structured product hedge fund, you own fixed income, options, and a side of high fees. If you didn’t have the structured product and just had the fixed income, you would have an equivalent hedge as per your asset allocation. The fixed income part provides some income that “guarantees” a return on investment (minus credit risk), and the equity component provides the growth potential.

Just because you have some money set aside in a separate bucket called a structured product doesn’t mean the money behaves any differently. Money is money; it doesn’t matter where it came from or where it is going. It is all part of your overall asset allocation.

What To Do Instead of Structured Product Investments

Own bonds. Have a well-constructed and thought-out Asset Allocation.

But let’s not be overly dogmatic.

There likely is a place for a very nervous investor who cannot tolerate market volatility to own a structured investment. Understand that structured products are bond-alternatives.

Equity-alternatives can also be an important part of your overall asset allocation.

Just understand you could create the same protection for yourself owning fixed income and equities as you can with a structured product investment.

That’s right. Equities do just as well (if not better) than options on equities over time. If you can just not sell low, if history is any guide, equities are perhaps the safest investment out there.