What is a Buffered ETF?

What is a Buffered EFT?

Buffer or buffered ETFs have been around since about 2018. The idea: you have some downside protection and a chance at growth. Does that sound familiar? Yup, another structured product!

These buffer ETFs are hedges against some investors’ behavioral issues and can be utilized differently.

What are Buffered ETFs? It’s the same as Buffer ETFs. Instead of being wrapped in annuity form (most commonly FIAs, but also the new dog on the block—RILAs) or sold by banks or broker-dealers as structured products, these are ETFs. ETFs have many advantages over annuities and broker-sold products.

The definition: a buffer ETF is an exchange-traded fund that uses derivatives to limit the downside by capping the upside of an index. The goal is to provide this cap and buffer over a defined period. As an ETF, they are tax-efficient, flexible, and liquid.

Instead of owning the stocks, you have options on them. The result: you might get less pain, but the cost is potentially a lot less pleasure! Let’s learn about the strategy, risks, and how buffered ETFs work.

How Buffer ETFs Work

Buffered ETFs have some downside protection, but this comes at the cost of limited upside. Usually, the protection is for a defined period, say one year. Still, you can exit early, enter late, or roll over into the following buffered ETF (which defers taxation of potential gains).

This is how buffer ETFs work:

You buy a call option on an index (such as the S&P500), which, if the market goes up, lets you buy the index in the future at today’s prices. This gives upside! On the other side of the call option are folks writing the calls for income, who presumably are okay with selling at higher prices in the future.

That part is easy to understand. The buffer is more complicated! The buffer involves buying and selling puts to “buffer” part of the downside but also selling a call option above the cap. This isn’t very easy, but the reason for these three options is singular: to provide income to buy the original call option.

So, to earn income, Buffed ETFs sell calls above the cap and puts below the buffer. This caps the return but funds the put to provide the buffer.

Fundamentally, buffered ETFs buy and sell options above and below the cap and buffer to provide income, which hedges the downside.

Ok, you don’t need to understand precisely how a buffered ETF works, but remember the paradigm that complexity favors the seller rather than the buyer. Buyer beware! Understand how these products might work in different situations, and you can forget their mechanics.

So, to summarize, you get the upside up to a cap, and you get a downside buffer until a certain level, and then you start participating in the downside again. Limit up and no down unless it is down a lot. The cap is the cap. The buffer takes away some of the initial pain of a down market, but only to a certain point.

Let’s look at how Buffered ETFs work.

Show Me How Buffer ETFs Work

Let’s look at a graph of how Buffer ETFs work.

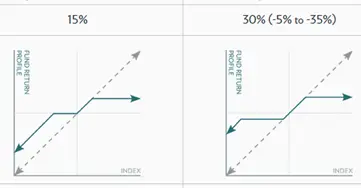

Above, on the Left, you can see a 15% buffer ETF. The dotted arrow are the possible returns of the index, and the solid arrow reflects the possible returns of the buffered ETF.

Start at the center. As the market goes up, you get a positive return until you hit the cap, at this point, there is no more return (so the arrow goes horizontal).

On the downside, there is no loss on the first 15% of the index’s losses. That is why the solid arrow stays at zero. Once the loss is more than 15%, you start participating in the loss. So, if the index is down 15% during the coverage period, you lose zero. If it is down 20%, you lose 5%. If it is down 50%, you lose 35%, and so on.

On the Right, let’s look at a slightly more complicated buffer. It is a 30% buffer, but to make it more affordable, it doesn’t kick in until there is more than a 5% loss.

You can see the upside is the same; there is a cap.

The downside, however, is that if you participate in the first 5% of the loss, then there is no more loss until the index is down 35%. So, if the index is down 5%, you lose 5%. If it is down more than five but less than 35%, you only lose 5%. If it is down 50%, you lose 20% (because there is a 30% buffer). Isn’t this fun!

Next, how might you use buffered ETFs?

How to Use Buffer ETFs

What are the use cases for buffered ETFs?

Use a Buffer ETF Instead of Cash

Do you have a lot of cash lying around? If you don’t mind losing some if the market experiences a significant downturn but want more than money market returns (which are zero-point nothing right now), you might put some of your cash into a buffered ETF.

We are attempting to correct a behavioral misstep: folks have too much cash and cannot get invested. With a Buffered ETF, you have an upside instead of staying in cash!

The risk of using this strategy is that you still sell once you are below the buffer, so you can still be a big loser with this strategy.

Use as a Bond-Alternative

What if you have a 50-50 portfolio and want to take more risk with your bonds? While I don’t think you should reach for yield, a use case for buffered ETFs is to replace some of your bonds.

You might see this called “liquid alts.” Use a Buffered ETF to try and generate more return from your bond part of the portfolio while you still have some downside protection.

While a correlation exists between buffered ETFs and a major down market, one might expect better returns with a buffered ETF than with bonds. Buffered ETFs are a potential bond alternative.

The use cases here are for folks more conservatively invested than they “should” be. The risk is that you dump this fund when the market is below the buffer and lose out instead of just holding on to your conservative portfolio.

Use a Buffer ETF during your Pre-Retirement Glidepath

As mitigation to sequence of returns risk, you might consider a buffered ETF as part of your pre-retirement Glidepath. As a reminder, sequence risk is most significant the five years before and ten years after you start withdrawals from your portfolio.

As you transition from accumulation to de-accumulation, you can put part of your transitional portfolio into buffered ETFs to partially hedge against sequence risk.

For instance, five years out, you might put 10% of your stock portfolio into a buffered ETF. The following year, you might buy 10% bonds. You would sell your buffered ETF in the final year and move into bonds.

Use of Buffered ETF as Part of a Bucket Strategy

If you have a bucket strategy, you might consider partially having your money out in a buffered ETF for 2-4 years.

Reduce Volatility and De-Risking with Buffered ETFs

De-risking before retirement is very important. If you are 80/20 and are on your way to de-risking, you might consider taking a “slice” of your asset allocation, say 10% of your stocks and 10% of your bonds, and putting that chuck into Buffered ETFs.

So, in the example, you would be 80/20 on your way to 60/40, you might do 70/20 with 10% in a buffered ETF for a few years.

Just an idea. But a complicated one at that.

You are Nervous About the Stock Market and Cannot Tolerate Being Invested in Anything Else

This is not a great reason, but some folks are so nervous that the usual suspect (diversification) doesn’t help them.

If the alternative is all cash all the time, a buffered ETF is better than nothing—but just a little better! Over the last three years, buffered ETFs have not outperformed a 60/40 portfolio.

Do Not Use as Equity-Alternative

If you have time, invest in low-cost index funds and hold them long-term. The major downside of buffered ETFs is that they massively underperform the indexes over extended periods. Buffered ETFs are not equity alternatives.

How Much do Buffer ETFs Cost?

Most funds’ expense ratio is between 0.7 and 0.9%. So, they are not that expensive.

The real expense is the underperformance you get in these funds compared to if you are invested in the index. If you can stomach the downturns—and not commit the cardinal sin of investing (selling low)—then you are much better off with simple, plain-old buy-and-hold-cost indexing.

Behavioral Aspects

As you know, no one knows next year’s market returns. They are positive most years but negative three times out of 10 on average.

The point is that you should not care! That’s right. Who cares what the returns are next year? You should only care twice about the price: what it is when you buy it and what it is when you sell it.

I suggest you use total market ETFs rather than individual stocks: You buy when you have money and sell when you need money.

But let’s be honest. Some people cannot look at the daily, weekly, or yearly market moves. Some will panic sell. Is a buffered ETF better than panic selling? For sure! If you can stay invested in a buffered ETF and otherwise would have sold low and locked in losses, consider buffered ETFs.

So, these products may be best for folks who have panic-sold, are now in cash, and don’t know what to do or when to get back in. Instead of dollar-cost averaging back in, why not buy a buffered ETF? Downside protection. Check—at least some exposure to the upside (or more than cash). Check. What is not to like?

Also Known As Other Names for Buffered ETFs

- structured ETFs

- defined outcome ETFs

- target outcome ETFs

- buffered outcome ETFs

- buffer ETFs

When You Purchase Affects Price and Performance

Remember that the option contracts usually last for a year after the buffered ETF is formed, so the price and the buffer/cap change over the year. You can go to the website and see what the cost of a 6-month-old fund is doing and how much of the buffer and cap are left.

Thus, it is important to figure out if you want to buy in at the beginning of the contracts or if you will mess with them intra-year and intra-contract. To know the right thing to do, you need to be able to predict market returns. If you could do that, you wouldn’t need buffered ETFs in the first place!

Taxation and Buffer ETFs

As you know, ETFs are tremendously tax-efficient. There should be no distributions during the year. Even more exciting, even though options are usually taxed at ordinary income rates, buffered ETFs should be taxed at capital gain rates. If you hold for a year and a day, you get long-term capital gains rates.

Summary– What is a Buffer ETF?

Buffer ETFs should not be used by folks who will never sell low. If you don’t have a problem with panic selling, don’t bother with these products!

But if you have sold low in the past, are looking to de-risk your portfolio, or are investing cash that you otherwise would leave sitting in the mattress, a buffered ETF is worth considering.

The risk to buffered ETFs is not the product—it is you! Behavior is everything in investing. Buffered ETFs are subject to losses during a massive downturn. More importantly, however, they should not be used as equity alternatives because the largest loss is the loss of participation in years with large positive gains.