Using a Margin Loan to Purchase Your Home

In early retirement, you may not qualify for a traditional mortgage based on a lack of W2 income. What about using a margin loan from your equities to purchase your home?

While I have written about mortgage acceleration, this is typically done with a HELOC (and a credit card) and implies that you plan to pay off your home more rapidly than the scheduled 15 or 30 years. Using a margin loan, you have to intend to pay off the home as well (or find another source of financing), and you have to put your money to work for you.

When you pay down your loan’s interest, you are “earning” that money without paying taxes on the earnings! Remember that money not spent is the same as saving money, so tax-free savings are important.

Using A Margin Loan Versus A Mortgage To Purchase Property

Ironically, Dave Ramsey says to pay down your mortgage and you can always borrow money on your home if you regret it. We know that investing beats paying down a 30 year mortgage (and a 15-year one usually as well). Buying a home on margin is like using home equity to invest in stocks.

Since homes appreciate around the inflation rate (depending on where you live, it is 2-3% per year), equities are usually a better deal since they go up about 10% yearly. This is also why a reverse mortgage makes sense—do you think your kids want an asset that appreciates at 2-3% or 10%?

Typically, you put 20% down and get a mortgage for the rest of the purchase price. Doctor’s mortgages feature slightly higher interest rates but may offer up to 95-100% of funding for appropriate candidates.

Mortgages can be 15 or 30 years or have a variable interest rate (often seen with balloon or lump sum payments due after 3, 5, or 7 years). Home equity lines of credit and cash-out loans are occasionally used for home purchases. Cash-in loans are utilized for some properties with variable interest rate caps expiring soon to lock in potentially lower long-term rates.

Using a margin loan means a brokerage house gives you a loan with your equities as collateral. Interest rates are variable and must be repaid, or they will be added to the loan. Thus, you must intend to repay this loan as your equities appreciate or via other cash flows.

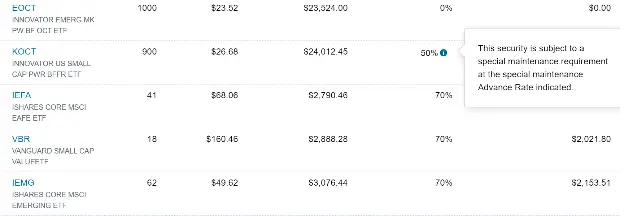

See above for an example of equities and the amount of leverage offered.

Not all equities are marginal, and you must keep below a 50% margin (say you have $1M in equities; the most you can borrow is $500k). You will get a margin call and be forced to sell low if you get to a certain margin, usually around 80%. This is awful because you lock in losses lower than if you just sold the stocks.

Because of this, it may be best to use margin loans in the short term until you can secure other sources of financing (like a more traditional HELOC that uses the home value as collateral). The value of a home is much more stable (or illiquid, as the case may be) than equities, so there is little risk of getting upside down in a HELOC (since it is no longer 2008).

Margin Loans Pros and Cons

Pros:

- No closing costs.

- No qualifying requirements.

- Minimal paperwork.

- Close quickly with a cash offer.

- No appraisal is needed.

- No Closing Costs.

- Ideal for an environment of decreasing interest rates.

Cons:

- Not all securities are marginable.

- Rates change as interest rates change.

- Force the selling of assets.

- Not fully tax deductible.

- Verification of assets not income required.

What is a Margin Loan?

You can use your equities (and bonds and cash, too, but that doesn’t make sense) as collateral for a loan. With that loan, you can buy whatever you want; I wanted a house.

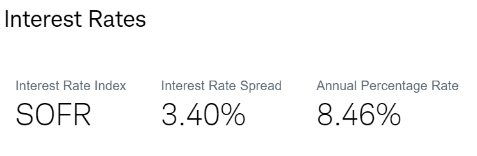

Generally, you pay a variable interest rate based on SOFR (see above), which may be similar to the interest rate you get on a HELOC. In my limited experience, you can find some brokerages that feature margin loans and advertise low rates; otherwise, you might have a higher rate than you get with a home equity line of credit.

Typically, you can get up to 50% of the portfolio’s value at the time of funding, but it depends on the underlying securities. The Fed regulates which equities are marginable and at what rate.

The main risk is that the market drops, exposing you to a margin call. Once your loan-to-value amount is about 80%, your broker will either ask you to give them some cash to cover their risk, or they will force the sale of your equities. This is horrific, of course, because it locks in the low price of the equities, which caused the margin call in the first place.

Buying a Home on Margin

Generally, you want to use a margin loan for a bridge loan while selling your current home, for instance, or when you are buying and don’t have time to go through the formal mortgage dance.

Margin loans have some tax benefits. You can take a margin loan instead of selling appreciated securities and paying capital gains taxes. This margin loan may be tax deductible if used on your home, but first of all, see your CPA about this, and second of all, remember that the standard deduction is so large that many married people don’t benefit from the mortgage tax deduction.

Well, I no longer have a W2 income since I retired early. I needed a source of capital, and a margin loan worked great. The interest rate is high, so I will use mortgage acceleration to pay it down quickly. The goal is to hold on to my equities because they will appreciate more than the interest rate for the next couple of years while I have this loan.

Of course, since a mortgage is like negative bonds, this makes my asset allocation 120/-20 or so. Oh, well, since we are at market lows, I can live with that. I hope!