Debt is Like a “Negative Bond”

A mortgage is like a negative bond, and leverage increases risk.

Jonathan Clements describes debt as a “negative bond.” He suggests if you have $100,000 in bonds and $100,000 in debt, your net bond position is zero.

Is a mortgage like a negative bond?

Does Debt Increase Risk?

Consider a high-income earner with a large brokerage account. Net worth is $2M, with a $400,000 brokerage account or a $400,000 mortgage. That is—keep the brokerage account and get a mortgage, or liquidate the brokerage account and pay cash for the home.

Asset allocation in this example can be 100/0, 80/20, 60/40, or 40/60 and is evaluated over time with or without a mortgage. The interest rate on the mortgage is 4%. Let’s follow over 30 years and see what happens to net worth.

Results are in present-day dollars.

Assume Constant Returns

The market fluctuates, but let’s assume constant returns and see how the different plans perform.

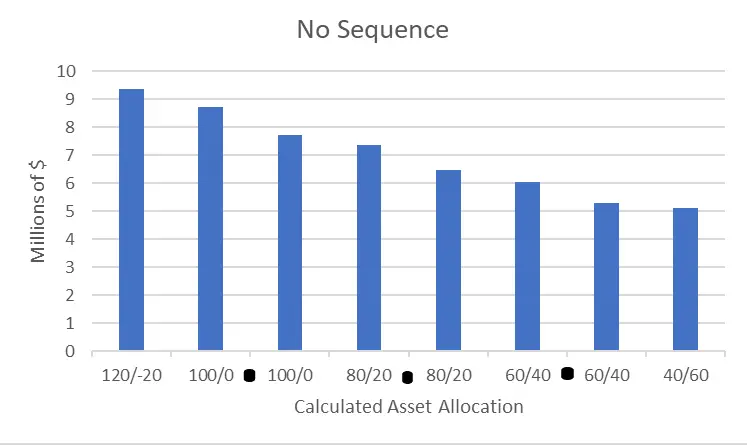

Figure 1 (Portfolio totals after 30 years with calculated asset allocations)

Take a second to get used to the data in Figure 1. The first two bars represent a 100/0 asset allocation, first with and then without a mortgage. Note that with the debt, the asset allocation is calculated as 120/-20 due to the mortgage’s negative bond. $400,000 is 20% of the portfolio value of $2M.

The second pair represents an 80/20 asset allocation with and without a mortgage. Then, 60/40 with and without, and the last pair is a 40/60 asset allocation with and without a mortgage. So specifically, the far-right bar represents a 40/60 asset allocation without a mortgage, and the bar to its left is a 40/60 asset allocation calculated to 60/40 due to the negative bond.

As expected—with continuous positive returns of 7% for stocks and 3.5% for bonds—the more risk you take, the higher the portfolio size is after 30 years. Portfolio value is reported in millions of dollars.

If we stopped right here, you would conclude that debt is like a negative bond. You take more risk with negative bonds and thus have a higher calculated asset allocation, so you wind up with more money.

But returns are not consistently positive! They come in sequences. What if we looked at the effect of the actual returns from 2000 to 2010 to see if there are any changes?

Assume Negative Returns Start Early

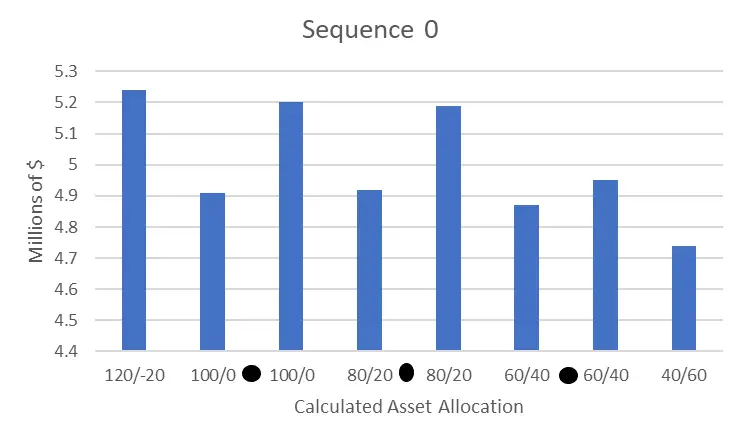

Figure 2 (Portfolio totals with negative returns starting at year zero)

Well, this looks different! Debt increases risk and return, thus improving outcomes. A mortgage is a negative bond!

When you add early poor returns, a mortgage beats paying cash! Again, all of the first bars in the pairs represent having a mortgage with the calculated asset allocation, and the second bar represents no mortgage. The bar graphs make the returns look remarkably different, but when calculated, the actual difference is just a 5-6% increase over the 30 years.

Asset allocation doesn’t matter in this setting; it is whether you have a mortgage or not! A mortgage—a negative bond that increases risk—keeps money invested in your brokerage account during the poor sequence. It is like investing a lump sum rather than dollar-cost averaging. If you put a lump sum in and the market tanks, well, you would have been better off dollar-cost averaging.

Remember, this is not sequence of return risk where you live on withdrawals from your portfolio. Instead, negative market returns help those in accumulation, as they allow you to dollar-cost average into low asset prices for future appreciation. So here, with or without a mortgage, she is dollar-cost averaging into the brokerage account.

In summary, you are better off being more conservative with a mortgage if a down market comes early during your mortgage.

Let’s see what happens if the poor sequence starts instead at year 10.

Poor Returns Start at Year Ten

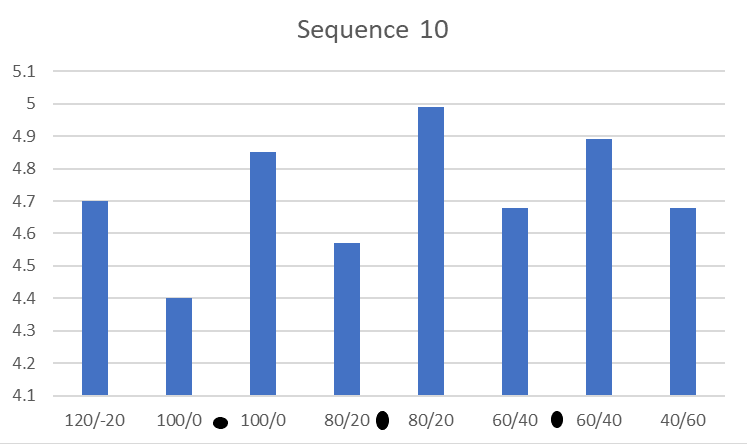

Figure 6 (portfolio totals with negative sequence starting at year ten)

This is interesting. Here, the calculated 80/20 portfolio with a mortgage performs better than the other asset allocation and mortgage combinations. Without a mortgage, you are better off being 60/40 or even 40/60!

Summary Table- Mortgage Negative Bond

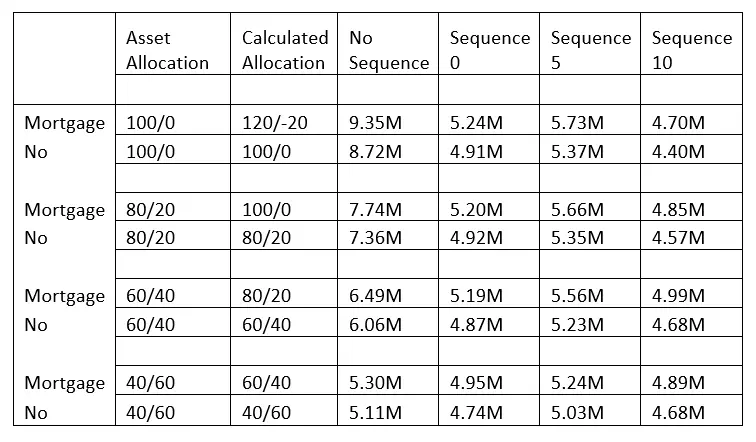

Figure 8 (Summary table)

See the summary table above. First, the asset allocation is listed, and next to that is the calculated allocation.

Despite the impressive appearance of results on the bar graphs, note that there is only a 10% absolute difference for sequence 0 and a 12% absolute difference for sequence 5 and 10.

How Does Debt Increase Risk?

With continuous positive results, debt acts like a negative bond. You increase your risk, so you increase your reward. Another way to say this is you leverage your equity holdings—you borrow money (as a mortgage) to invest in equities. It is nice to see the smooth downward slope of Figure 1 with decreasing risk.

However, debt has no 1:1 relationship with bonds through turbulent markets. You cannot just subtract debt from bond value and say that is your asset allocation.

For all pairings, a more conservative asset allocation with a mortgage (thus a higher calculated asset allocation) beats its competitor without a mortgage but with a higher baseline asset allocation!

Said another way, negative bonds (a mortgage) are RISKIER than we think. Debt returns MORE than the expected equal decrease in bonds, as predicted by a 1:1 relationship. If I sum and average all the results, debt has a 1.06:1 negative bond relationship.

So, you are taking 106% more risk by having debt than owning bonds.

Conclusion- A Mortgage is a Negative Bond

Some view debt as just a line item on monthly expenses. They ignore it in their risk calculations.

Others counter that if debt is a negative bond, then a job is a massive positive one!

Is debt like a negative bond? Yes! Borrowing on your home instead of paying cash increases your risk and potential return.

Typical advice for those in accumulation includes having the highest asset allocation you can tolerate. Of course, some have bonds for downside protection. This is to prevent the worst mistake in accumulation: selling low and locking in losses when the markets tank.

Less attention is paid to the risks associated with debt. If you want to be even more aggressive, consider mortgage acceleration!

Remember, money is fungible. This implies that if you have a mortgage and are investing, you are borrowing on your home to invest the money. As the expected returns on equities are more significant than a mortgage’s costs, this generally works well.

When you are young, you can use the “leverage” of a mortgage to allow early investing in equities. This “negative bond” feature of investing during the accumulation phase is a truism of finance hidden in plain sight. Many people do it, but they don’t understand the reason behind it: that leverage increases risk and reward.

If you have the cash but choose to leverage debt, consider debt riskier than a negative bond.

Maybe ask yourself if it will matter all that much in 20 or 30 years. The answer to the “pay off debt vs invest” question is “yes!”

Savings rate is all that matters early on! https://www.fiphysician.com/15-year-vs-30-year-mortgage/