Buffer Assets to Mitigate Sequence of Returns Risk

Buffer Assets can be used to mitigate sequence of returns risk. In fact, I would consider any strategy aimed at reducing sequence of returns risk as a buffer asset!

After all, an asset is not just an investment. Assets are also strategies, advantages, resources, or anything else you can use in defense against sequence risk.

Let’s define buffer assets and see how they work.

Buffer Assets: A New Definition

A buffer asset is anything that can mitigate sequence of return risk. From an academic standpoint, the answer to the question “how do you defend against sequence risk” is: Buffer Assets.

Buffer assets provide the luxury to sell equities at your leisure. In contrast, without buffer assets, one is forced to sell stocks when they are down—or reverse dollar cost average. This is, in fact, the demon of retirement—Sequence Risk—selling low and locking in losses.

Classification of Buffer Assets

I want to suggest the following classification system for buffer assets.

- Flexible Cashflow – reducing spending after portfolio decline is effective in mitigating sequence risk. In fact, it is also a natural behavior when the economy is in recession. Folks note what is going on around them and spend less. In addition, there is the income side of the equation.

-

-

- Expense Modification: Income need is driven by expenses in retirement. One can modify spending (spend conservatively or have guiderails for spending).

- Income Generation: Depending on other income sources, using human capital (i.e., part-time job or a side gig) can decrease income demands on the portfolio.

- Additional Income: Income from rentals, patents, and other passive income streams decreases the withdrawal rate from the portfolio and, thus, the stress from sequence risk.

-

- Dampen Volatility—during downturns in the market, think about strategies and investments that may be less affected by the chaos.

-

-

- Volatility Ladders: “Ladders” of CDs, bonds, or MYGAs. Consider laddering a combination of 2 or 3 of these depending on interest rates.

- Planned Allocation Strategies: Rising equity glide paths or bond tents are important considerations.

- Goal Segmentation Strategies: Guaranteed fixed income “floor” provided through social security, pensions, annuities, or TIPS.

- Annuity Strategies: Social security claiming strategy, income from immediate annuities, or longevity insurance from deferred annuities.

- Income Portfolio: Preferred stock, dividend stocks, utility stocks, REITs, convertible bonds, and MLPs are not infrequently used by investors for “bond-like” exposure.

-

- Uncorrelated Non-Portfolio Assets—these assets are not market-based and therefore are less correlated (rather than non-correlated) with market returns. They can be sold or borrowed from during downturns in the market to prevent selling stocks when prices are low.

-

-

- Cash Reserve Strategies: Cash is for spending and not an effective buffer asset. I would remove this from the classification.

- Classic Buffer Assets: Cash-value life insurance and reverse mortgages have a low correlation to market returns and tax-free “income.”

- Other Assets: Businesses, hobby collections, rental properties, or other assets can be sold to hedge against a down market.

-

Use of the Buffer Assets Classification System

Buffer Assets mitigate against sequence risk. Using the above classification, there are considerations for cash flow, volatility, and uncorrelated assets.

Retirement is an exercise in income creation. Rather than work to provide income, stored reserves of work (money) provide for spending. Let’s look at how the Buffer Assets interact with income generation (from de-accumulation) and sequence risk.

Flexible Cashflow

Cash flow is important in retirement. Again, income creation is what makes de-accumulation more difficult than accumulation. We see in the above classification system there can be a role for a part-time gig to prove incoming cash flow. In addition, modification of expenses—spending less—is common and expected during cyclical downturns in the economy.

Rental income and other passive streams of income are also important considerations. This income reduces strain on the portfolio by decreasing Safe Withdrawal Rate (SWR). Even a slight decrease in SWR tames sequence risk during a traditional 30-year retirement. During a prolonged retirement, a 3.25% to 3.5% SWR is more sustainable. Having passive income streams in retirement is an ideal way to reduce sequence risk.

Volatility Dampeners

This category has several themes.

First, decreased stock exposure during five years before to 10 years after retirement. This is the highest risk time for poor return sequences. Decreased exposure occurs via “ladders”—where you have your income needs met through timed maturation of investments. Additionally, a programmatic increase in equities once much of the risk has passed decreases exposure to sequence risk.

Second, flooring or meeting income needs with guaranteed products such as social security and other annuities. Similar to passive income, flooring decreases the Safe Withdrawal Rate and immunizes against sequence risk.

Lastly, a segment of investors employ income portfolios to decrease volatility. Dividend investors are frequently proud of the dividends they receive from their investments. This income decreases volatility by decreasing the need to sell stocks for income.

Uncorrelated Non-Portfolio Assets

Folks have assets outside of the stock market. These assets–homes, insurance policies, businesses, hobby collections, etc.–have lower correlations with market returns. Obviously, home prices are affected by the economy. Most prices are.

Uncorrelated is perhaps not exactly the right term, but it sounds better than “less-correlated.”

A home’s equity can be used via a reverse mortgage or a home equity line of credit. Permanent life insurance provides tax-free “income” via withdrawals or loans against the cash value. I call these classic buffer assets; the original buffer assets recognized by Dr. Pfau.

Other assets can be sold as needed to provide a bolus of cash and decrease the need to sell equities when they are down.

Let’s now move on to mitigating sequence risk with buffer assets.

How to Mitigate Sequence Risk with Buffer Assets

How do you mitigate your portfolio against sequence risk?

As we know, sequence risk is one of the most significant risks someone new to retirement faces. In fact, this risk starts 5-10 years before retirement!

Further, we all know about the 4% rule. The purpose of this infamous withdrawal strategy IS TO mitigate sequence of withdrawal risk. Beginning with this (quite) low inflation-adjusted withdrawal rate, you outlive your money most of the time when using historical equity and fixed income returns.

Buffer assets are an exciting concept. These assets are non-correlated with the stock market, so they can be used to prevent negative dollar-cost averaging. That is, if the market is down, you don’t have to sell low to provide income during retirement. Instead, harvest a buffer asset when the market is down.

Let’s look at a fictional scenario and see how buffer assets work to reduce sequence of returns risk.

Scenario

Consider a fictional couple who just retired at 64. They have $4.5M in assets which includes a $1M house, $500,000 in cash value life insurance, and $500,000 of LLC shares, paying 5% a year.

They have a $1M taxable account with a large cash reserve and US and International stocks and bonds. In their $1M rollover IRA, they are 60/40 US stocks/bonds. Their $500,000 Roth IRA is more aggressively invested. Social security will provide $3000 a month at age 65. They plan on spending $150,000 a year, a 6% withdrawal rate from their investments or a 3.3% withdrawal rate from combined assets.

| Year | Stock | Bond | Cash |

| 1 | -9.1 | 11.6 | 3.5 |

| 2 | -11.9 | 8.4 | 1.6 |

| 3 | -22.1 | 10.3 | 1 |

| 4 | 28.7 | 4.1 | 1.4 |

| 5 | 10.9 | 4.3 | 3.2 |

| 6 | 4.9 | 2.4 | 4.8 |

| 7 | 15.8 | 4.3 | 4.5 |

| 8 | 5.5 | 7 | 1.4 |

| 9 | -37 | 5.2 | 0.15 |

| 10 | 26.5 | 5.9 | 0.14 |

| 11+ | 6 | 3 | 2 |

(Assumed sequence for this scenario)

Above, see the sequences from 2000-2010 against which we will stress various scenarios. Note from year 11 until the end of the plan, return on stocks is 6%, bonds 3%, and cash 2%. These may be low on average but are nonetheless interesting to look at as an added stress.

Results of the Plan

Monte Carlo simulation of this plan demonstrates an 82% success rate using standard returns on financial planning software. Stress testing reveals concern for a market crash, inflation, and longevity. Net worth at year 90 (end of plan) is $5.8M, with their portfolio worth about $3.8M.

When we stress this plan with return assumptions above, however, there is a zero percent chance of success, and their portfolio expires at age 84.

Now, let’s examine some different options for mitigating the portfolio against sequence risk.

Delay Social Security

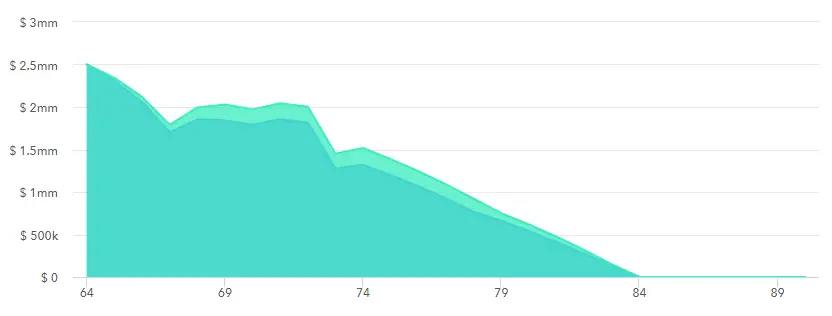

(Delay in social security)

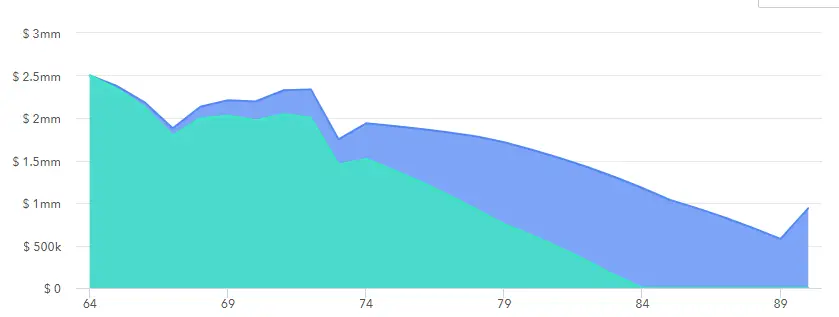

What if they delay claiming social security? The dark green demonstrates portfolio value over time if they delay to 70. The lighter green shows portfolio value if they claim immediately. Over time, we see the investment accounts expire at age 84 with either strategy.

The cross-over point where income from social security is higher due to a delayed claiming strategy is age 79. It is interesting to note they actually do worse with a delayed claiming strategy as they have a higher distribution rate from the brokerage account before claiming, and this occurs during some very negative years of market returns.

Therefore, claiming social security early to mitigate a poor sequence does not effectively immunize a portfolio. During years of negative stock market returns, decreasing the withdrawal rate slightly (by claiming early) does not make up for the loss of income in the long run.

A More Conservative Allocation

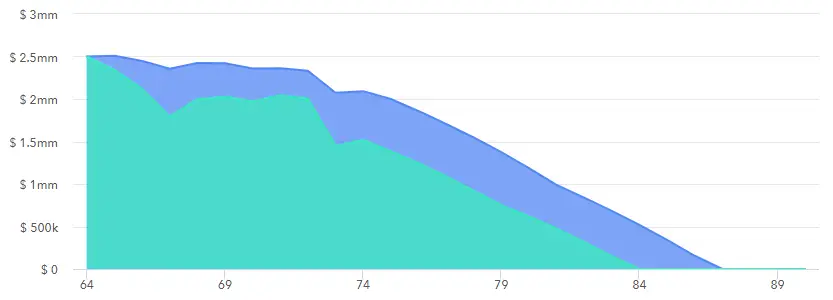

(20/80 Asset Allocation)

What if they were more conservatively allocated? Above shows the effect of a 20/80 portfolio, with 80% of their assets allocated to fixed income. Although they suffer from less volatility (especially during the down years), they only have an extra $500,000 after the poor sequence. However, the initial drawdown in the portfolio value is eventually eaten away by inflation, and the portfolio expires at year 87.

A rising equity glidepath or a bond tent would improve this scenario. These allow programmatic increases in equity exposure without “market timing.” Unfortunately, however, I cannot demonstrate these changes in portfolio allocation with the current planning software. This is a good reminder that a financial plan is not set in stone and requires periodical re-evaluation.

Bond/CD Ladder

Bond and CD ladders are popular for sequence risk planning. For a significant upfront investment, you can guarantee five or more years of income.

($75,000 a year bond ladder)

In this scenario, $500,000 is used to purchase an 8-year treasury bond ladder paying out $75,000 a year. A Bond/CD Ladder Toolkit helped model the purchase price.

As seen above, this bond ladder fails. Note that at year 9, there was a significant drop in market prices, so perhaps a ten-year bond ladder may have performed better. CD ladders or use of MYGAs are not modeled but also suffer from current low-interest rates.

Given low current interest rates, a treasury bond or CD ladders are not that exciting. Historically, when interest rates were closer to 6%, a similar bond ladder costs about 20-30% less.

What about Selling a Business?

(Sale of the business)

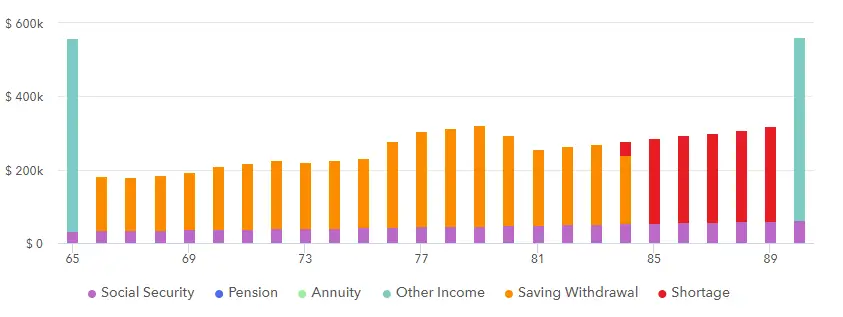

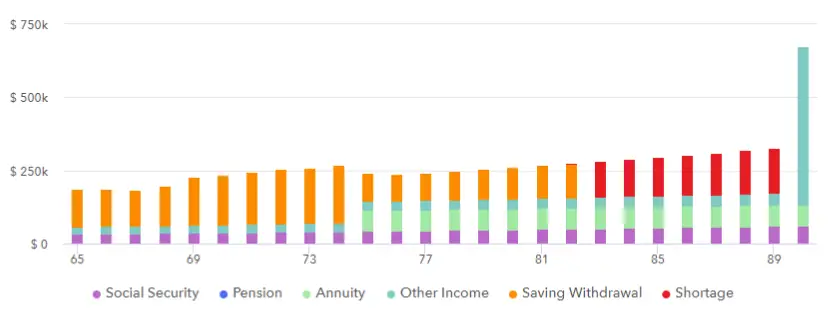

They do have assets outside of their portfolio. The figure above shows income sources for retirement. As seen above, when they are 65 years old, they sell the LLC and receive $500,000 in income (though they lose the 5% returns for the rest of the plan). In this scenario, they still run out of money at age 84. A poorly timed infusion of cash is not beneficial during these harsh sequence. The income peak at age 90 is the life insurance policy paying out upon death.

What About Annuities?

In this scenario, the fictional couple really didn’t need income, so models of single premium immediate annuities (SPIAs) are not shown here–they didn’t help mitigate against sequence risk in this scenario anyway. Let’s look at differed income annuities (DIAs) and see if they can mitigate sequence risk.

(10-year $500,000 DIA)

Income sources are shown above with a DIA. Assume $500,000 from the brokerage account purchases DIA payments of 14.2% after a 10-year deferral period. Note that we have social security and income from the LLC. At ten years, the annuity starts to pay, as well, but their investment accounts run dry at age 83. The large withdrawal from the brokerage account raises the withdrawal rate from the portfolio higher than can be tolerated during SORR, leading to this poor result.

Get a Job

What about working in retirement to increase income? Given their high spending levels, they would have to earn $60,000 a year for ten years for Monte Carlo analysis to be above 50%. They are already in high tax brackets from other income, and it is challenging to out-earn their high spending rate.

What Works?

Let’s now demonstrate effective ways to mitigate sequence of returns risk in this scenario.

Decrease Spending

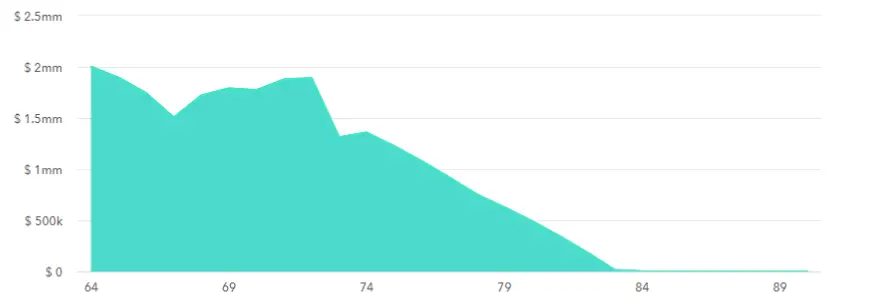

(Decreasing spending to $120,000 a year)

Variable spending strategies are important for retirement income planning. Logically and emotionally, this is what most retirees will do during down markets.

Note that the portfolio is not much larger even after the second major decrease in the stock market. Still, the tail end stays much higher, showing that likely they could have increased spending again after the sequence of risk evaporated (usually about ten years).

Cash Value Life Insurance

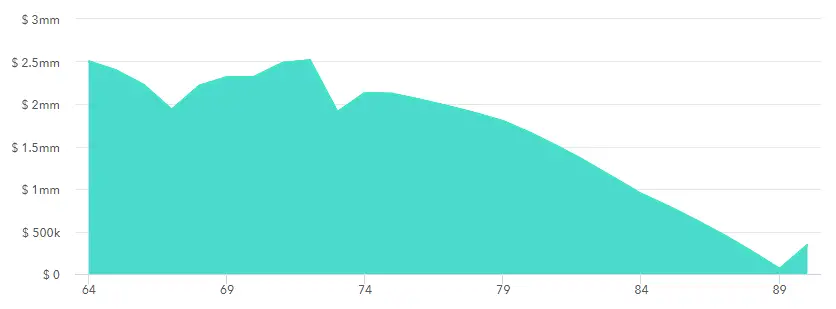

(50k loan a year from cash value life insurance)

You can “borrow” the cash value of a permanent life insurance product tax-free. In this example, $40,000 a year is borrowed from the cash value of the policy for ten years. Even though this is a fraction of their spending, the results are impressive, and this plan does not fail. Cash-value life insurance is not a popular topic among DYI investors, but clearly, it is a consideration for those worried about sequence risk. You can pay back the money you borrow from your life insurance, or it can be deducted from the death benefit when the time comes.

The problem with borrowing from your cash value life insurance policy is, of course, it must be set up decades before it is needed. In this example, the life insurance is counted as an asset, but of course, this is an asset outside of the portfolio and not correlated with stock returns.

Reverse Mortgage

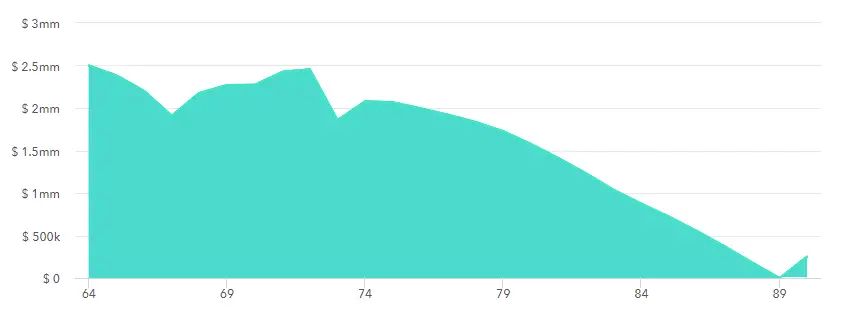

(Reverse mortgage of 40k a year for ten years)

Reverse mortgages have become slightly more popular in the last few years, primarily thanks to a book. It suggests a Home Equity Conversion Mortgage (HECM) be used early in the planning process rather than as a last resort (as home mortgages are considered in popular culture). These are FHA loans with mortgage insurance written into the deal. HECMs are non-recourse loans, which means as long as the property is kept up and property insurance and taxes are paid, the homeowner keeps title and cannot be evicted. The loan-to-value amount is based upon the owner’s age (you must be at least 62) and current interest rates. The lending limit is based upon a maximum value of $726,525 and is usually 40-60%.

HECMs have a line of credit option, which is of most interest. You can open the account and only use it if needed. Also of note, this line of credit grows larger with time.

In order to combat a negative sequence, draw on your line of credit in years when equities are down to avoid reverse dollar-cost averaging. Money from the line of credit is tax-free, which may be especially important if you are getting income from your fully taxable IRA or if additional ordinary income would increase taxation of social security or cause increased Medicare surcharges.

Above, in figure 10, you can see that a reverse mortgage does, in fact, adequately mitigate sequence risk.

So, Which Mitigation Would You Choose?

In summary, only three strategies perform well against a repeat of the market foibles from 20 years ago.

Spending less money, or even a variable spending plan, is an important consideration.

Other effective assets to consider are reverse mortgages and cash value life insurance. Obviously, cash value life insurance must be set up decades in advance but is a consideration for high-income individuals who already have sizeable tax-deferred retirement accounts. While reverse mortgages can be set up anytime, the amount you can borrow from actually increases with time if you set up your mortgage early (though, of course, after 62). The key to these assets: they are not correlated with stock market returns, and equally important, the “income” is tax-free.

Final Thoughts on Mitigating Sequence Risk with Buffer Assets

Corrections and bear markets are common and expected. The lost decade of the 21st century, however, saw two “100-year events.” Maybe we won’t see such downside risk again in our lives. Maybe.

Thus, it does take planning to make sure you don’t crash and burn due to sequence risk in early retirement. That actually is the point of retirement planning. No single mitigation strategy is perfect for everyone. Likely a combination of investments, products, and strategies will be needed to spend freely during your early retirement, all the while planning to live a long and comfortable life.