Crypto Returns and Sequence Risk from When I Retired Two Years Ago

(This blog was published when I had been retired for two months. This is an update of my real stories from a recent DIY retirement.)

During the first month, I was surprised by how it felt to have a negative cash flow (massive, really) in my checking account after a sizeable inflow from an NG-457 gaffe. You really cannot prepare yourself for financial inconveniences once the income ends.

The next story from my DIY retirement is an update of asset allocation, net worth over the last five years, and, of course, my 1% investment in crypto as I retired in 2022.

Let’s start with Asset Allocation.

Asset Allocation and My Sequence of Returns Risk

I enjoy calculating my net worth and asset allocation when the market is down (and occasionally at market highs).

My goal asset allocation is between 70-80% equities for the long run. Unfortunately, life happened, and I’m 110% equities, buying a home with a margin loan. It’s a long story, but no one wants to buy a house right now, given unfavorable local market conditions.

It’s a modest, like-new house in a mature neighborhood in walking distance of Pizza Hut, my gym, and a home for my children.

My personal sequence of returns risk has not been great since I retired two years ago. There was the worst market almost ever for a 60/40 portfolio in 2022 and 9% transitory inflation.

The 60/40 has been declared dead for decades so TINA into 90/10 and then retire into inflation for the first time since the 70’s. And then, because life happens, you have to buy a home. That’s my sequence of returns retirement risk.

Despite that, markets are up, even after inflation. It is a good time to own equities. It is true since I retired in 2022 and ever since data has been collected on stock markets.

Net Worth Two Years after Retirement

It is fun to calculate your net worth. Retired it is interesting to see your net worth compared to other retired physicians.

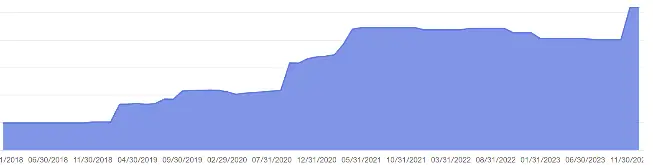

Below is my net worth over the last five years.

My net worth is lumpy because I don’t update it often. It started in late 2018 and shows the effect of compounding interest of a paid-off primary home and decades of maxing out pre-tax accounts.

Despite the ups and downs of the stock market, because I only rarely calculate my net worth, it goes up over time. That happens even to W-2 folks who save 15% of their money for 15 years.

Die with Zero suggests that you reach your max net worth in your 40s or 50s. I’m still unsure about the math, even though I have read the book twice. Maybe I need to retire twice to understand.

I Bought Crypto

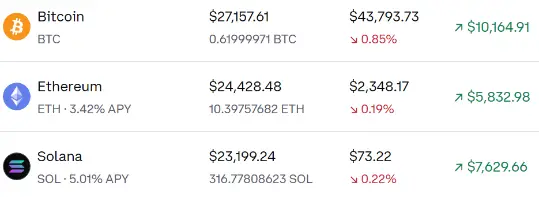

My asset allocation includes about 2% into three cryptoassets. It has doubled since my retirement in 2022.

As I said two months after retirement:

It is time to get 1% invested. You should expect to lose this money; invest for 5-10 years

Crypto is an equity alternative that I bought in 2020.

Below, I invested 1/3rd in Bitcoin, Ethereum, and Solana. I’m getting paid 3.4 and 5% APY (yet unclear how that gets reported on taxes every year). I bought when bitcoin dropped from 70 to 19 and my thesis at the time is that you can’t kill Bitcoin and maybe 1% of my money would be fun to invest in a diversified crypto portfolio.

So, I picked Bitcoin, like digital gold; Ethereum, which you might program upon; and Solana, the best alternative. Is that diversified?

Real Stories from a Recent DIY Retirement

I used to specialize in Infectious Diseases, and now I specialize in Retirement Planning for DIY Investors.

This is my real story of retirement. I am a DIY retiree, yet I have academic training. After two years of retirement, I don’t have (yet) a fool for a client.

I’m 50 years old and two years into retirement. I decided to take 4% next year because sequence of returns risk no longer bothers me. Although I’m all in equities, I still have two standard deviations.

I’d love to buy bonds, but have a variable 8% hurdle. Historically low. I’ll de-risk just as soon as I can pay down debt.

Love this, and it’d be great to see more of your thoughts as you continue the transition. It took me a solid six months to get into a new and comfortable groove after retiring. My first months were a weird mix of feeling like I should be “productive” all the time and simultaneously trying to rest/destress now that I had time to do so. Next phase was the energetic “wow, I have time for everything!” phase, followed by the “nope, I still need to prioritize” phase. 🙂 Good balance now, with very little money stress, though we’ll see how any further market drops affect that. I feel comfortable with the plans I have in place. Have you had to answer the question “What do you do?” yet? I struggle to answer that without saying “I used to…” and end up giving a slightly different answer every time.

Great post! Love the new you! Lol Sharing your life story.

You actually did it. Nice job Dr. Dave. I have no doubt you will (eventually?) get over the loss of the paycheck, as we did. I guess we are now dealing not only with sequence of returns (stocks and now for me, even bonds at our 50/50) and sequence of inflation. Fortunately we are well-positioned. Good reminder on real estate-ours certainly has not doubled like yours but there has been a nice increase (maybe 30%?) in last 18 months. I think it is the right approach to leave out the financial details. I like the personal story which I find more impactful than a “clinical” financial discussion. 🙂

Simple math, 1 million is 18 percent of what? So the clinical detail is still there, about 5.5million increasing to 6.5 million.

Thanks for the stories and yes, life is an interesting journey. I will look forward to further updates on your retired life transition at the same time I am going through mine. I have been on a gradually declining schedule for the past five years and have decided to fully pull the plug at the end of June and join you in the next phase. I certainly enjoy your site and the personal financial consultations you have provided. Best wishes until we talk next.

I also mostly (90%) retired. Then the market dropped like a stone. I believe we will be ok but mostly my wife is anxious.

We are or were at 60/40. I have managed without a paycheck by transferring funds esp RMD’s and spending it without any budget and filling the check book up when needed. Our needs have really dropped, but with travel being planned it will again go up. I don’t have a real plan on where to harvest the cash I need but have planned to take it out of the 40% when the market is down and the 60% when the market is up. Have just reviewed a presentation from Rick Ferri and am comtemplating the 3-4 funds plan as I have way too many.

Thanks for you web site and I agree I enjoy readying the stories as well.

Steve