Cash Flows – Boring to Talk About

Cash flows are a powerful tool in retirement planning. They are also extremely boring to talk about, and who wants to read a blog full of columns of numbers? You do? Ok, let’s dig in!

What are Cash Flows in Retirement Planning?

Remember that retirement is all about turning assets into income. Cash flows reflect the ins and outs of retirement planning: what is coming in and what is going out, and from where once you retire.

As your sources of income come online in retirement, you have more income. You have to plan out your sources of income and know what year they start. Next, expenses include taxes, which you can control during your tax planning window. You might need to do a series of partial Roth conversions to control your lifetime tax liability (and that of your heirs).

You want to know what happens, for example, when you are 65-70, when you turn on social security, and when RMDs start.

Cash flows are the lifeline of retirement planning. What is happening when?

An Example of Cash Flows in Retirement Planning.

Let’s look at an example of cash flows for a theoretical high-income couple.

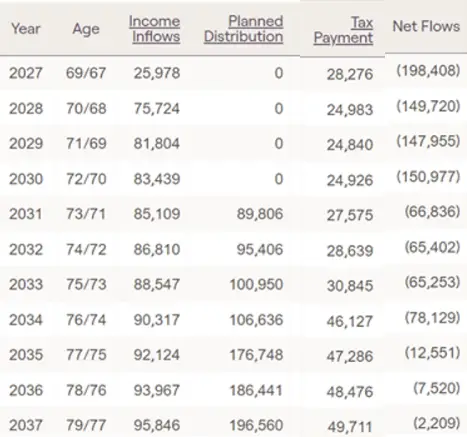

Above, you can see the cash flows from a couple between 2027 and 2037.

Note the year and their ages, and the first column is income. The younger spouse takes Social Security at 62, and the older spouse (with the higher SS benefit) takes Social Security at 70. Note the increase in income that year.

Next, you can see planned distributions. These are RMDs. Due to Secure 2.0, the older spouse takes RMDs at age 73, but the younger spouse can delay until age 75.

The next two columns are total inflows and then expenses. Expenses inflate at 2%, and healthcare expenses inflate at 5%.

Next, note taxes due each year. Note how small taxes are just with one social security benefit, then see the increase when the older spouse turns 70 and the second SS benefit starts. Then, see the increase in taxes when the RMDs start at age 73 and then 75. Quite a big change!

Do you think they should do Roth conversions?

One big hint is the net cash flows, seen above. Note they are negative initially, but as the income sources come online, they wind up positive.

What do positive cash flows mean during RMD years? It means the government is forcing you to pull money you don’t need out of your IRA, and thus, you are paying more taxes than you need based on your future expected cash flows.

Interesting! That is a hint that you need to do Roth Conversions.

If they do Roth Conversions to fill the 15% tax bracket, let’s look at cash flows.

Cash Flows with Roth Conversions

Above, you can see the cash flows with Roth Conversions. Note the change in the planned distributions. They are smaller since we have debulked the size of the IRAs and thus decreased future RMDs.

This is tax bracket arbitrage!

Next, taxes owed yearly are larger until the RMDs start, and then they are quite a bit smaller for the rest of their lives.

Finally, note the net cash flows are even more negative initially but do not turn positive once all the sources of income are available. That is, they are no longer forced to take out money that they don’t need, paying taxes that they don’t want to because of RMDs.

Taxes and Cash Flows in Retirement

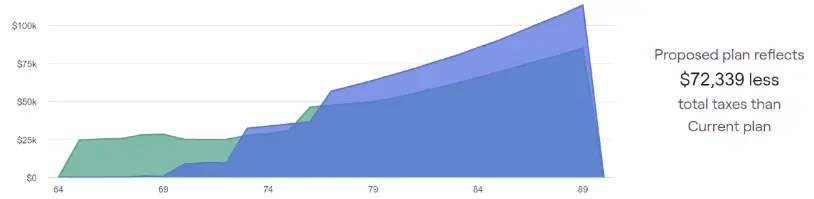

Above, you can see yearly taxes owed with Roth conversions (green) and without (blue). Overall, they only save a modest $72k in taxes over their lifetimes, but that money can go directly to their heirs rather than to the federal government.

Next, let’s look at the actual Roth conversion plan.

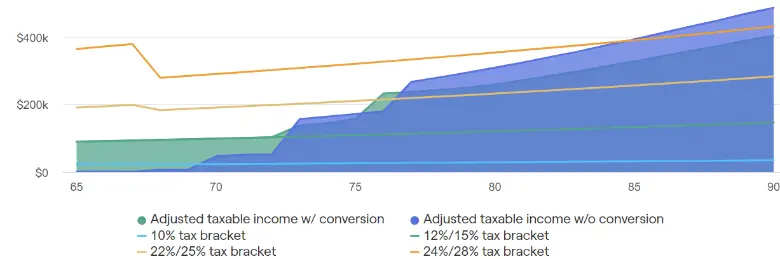

Above, you can see that they fill up the 15% tax bracket with Roth conversions and then have less money exposed to the 28% tax bracket once RMDs start. This is why they save on taxes. They pay 12 cents (or 15 in 2026 once the Tax Cut and Jobs Act expires) to “liberate” a dollar from their IRAs vs. 28 cents once RMDs start.

Looking at the graph and the cash flows, we “overoptimize” Roth conversions. That is, they run out of brokerage accounts due to paying taxes because of Roth conversions and thus have to pull from their IRAs to pay the bills before RMDs start.

We wouldn’t do this in real life, as we need to maintain a brokerage account balance to keep some flexibility and optimize taxes.

Roth conversions are a yearly decision you make in late November or early December every year. We use cash flows to predict Roth conversions (because net flows are positive after all the sources of income come online) and then decide our goal conversion bracket.

For this theoretical couple, it may make sense to do some conversions at 24% before TCJA expires in 2026. My bias is to keep smaller conversions going for longer at the 12 and then 15% tax brackets.

Cash Flows in Retirement Planning

Understanding cash flows is the lifeblood of retirement as you turn your assets into income.

As income sources come online, you note that your net flows change. If you have positive net flows after RMDs start, Roth conversions might be indicated.

Cash flows are the lifeblood of retirement planning. Get yourself a spreadsheet, or better yet, use professional planning software.