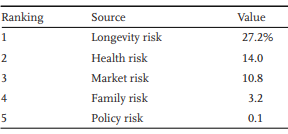

Sources of Income in Retirement

Sources of Income in Retirement What are the sources of income in retirement? Let’s develop a semi-comprehensive list and discuss when you might access each. Sources of Income Retirement accounts IRAs and 401k plans represent the largest bucket of […]