Planning for a SEPP 72(t) and FIRE

Learning about a SEPP 72(t) is a rite of passage on the journey to FIRE.

Do you need a SEPP 72(t)? How can you model one?

Or, wait, should I build a 5-year Roth Conversion ladder instead?

Let’s look at a hypothetical early retirement and model a SEPP 72(t), then discuss when you might be better off doing a Roth Conversion ladder instead.

And, as of 2022, the IRS has allowed a new Rate. Now, you can get higher payments from your SEPP in early retirement!

UPDATE 2022: New 5% Minimum Interest Rate

IRS notice 2022-6 is new for 2022 and changes the math for a SEPP in early retirement.

If you use either the annuitization or amortization method (see below), you can now use a minimum interest rate of 5% or the older (and usually much smaller) interest rate that has been around since 2002.

This means you can withdraw about twice as much with a SEPP 72t in early retirement as before this minimum interest rate change! This is important as it gives you more options if you need more penalty-free income in early retirement.

Of course, if you need less, you can always separate the IRA from which you are taking a SEPP and leave the “extra” money in a non-SEPP 72t IRA.

Having the option to withdraw more from your IRA in early retirement is a good change, and we welcome this update to the SEPP rules in 2022!

What is a SEPP 72(t) SEPP?

Some have the bulk of their money saved up in pre-tax retirement accounts in early retirement. You saved up all that money; the last thing you want to do is pay a 10% early withdrawal penalty by pulling it out of an IRA before 59 1/2.

Of course, there are exceptions to the IRA early withdrawal penalty (which I discussed in my bit on using QDROs to avoid paying the penalty). This is another very advanced FIRE technique that is rarely attempted—and also might be useful if you want to pull your money out of your 401k to invest in real estate).

Most can’t find an exception to the early withdrawal penalty. If that is you, the Retire Early doctrine states that you should consider an SEPP or a Roth Conversion Ladder.

Substantially Equal Periodic Payment (SEPP) via IRS Rule 72(t)

What is a series of substantially equal periodic payments? Codified under IRS rule 72(t), you can take money out of your IRA before 59 ½ without penalty. It is one of the penalty exclusions listed in the IRS code, but we are giving it full attention because it differs from the others.

However, extreme caution is indicated with a SEPP as if you blow it up, it becomes taxable with a penalty. Generally, it is a good idea to plan this out well in advance. Get your CPA and IRA custodian involved. Do not mess with the underlying IRA (no additions or additional withdrawals); take out your payment each year for as long as required. More on the mechanics later.

It is also interesting to note that there is a 72(q), which lets you access non-qualified annuity funds before 59 ½. I hope you don’t have a non-qualified annuity, but if you do, you can access it penalty-free.

Roth Conversion Ladder

To complete the Roth Conversions 5-year Ladder, you must make yearly Roth conversions to pay for living expenses five years from now. Again, care must be taken with this plan!

You can pull out Roth CONTRIBUTIONS anytime without tax or penalty (even on backdoor Roth contributions). Roth CONVERSIONS, however, have a 5-year seasoning period. So you can’t just take conversions right back out without a penalty.

This is confusing because there are two types of 5-year rules on Roth IRAs. The rule on conversions is created specifically to PREVENT folks from getting around the 10% penalty for early withdrawal on IRAs. You cannot convert to a Roth and then take the money out. You must wait five years.

The other 5-year rule is about taxation on the growth of a Roth and doesn’t apply here.

So, if you need penalty-free IRA withdrawals in 5 years, pay the taxes this year by converting your IRA to Roth. After waiting five calendar years, you can pull out the money tax and penalty-free even if you are less than 59 ½!

Why Doesn’t Everyone Do a Roth Conversion Ladder Instead of a 72(t)?

To do a Roth conversion ladder, you must have enough after-tax money to live on for five years and to pay the taxes for the five years of conversions.

So, if you have a lot of money in your brokerage account, a 5-Year Roth Conversion Ladder may be for you. But if you only have pre-tax money, you are stuck with a 72(t) SEPP.

After you build your Roth Conversion Ladder, you have very low taxes as you have pre-paid the taxes during the ladder-building process. This is done in a series… year one, you convert for year six, in year two, you convert for year 7, etc. Eventually, five years later, you will be 59 ½ and no longer need to worry about the 10% penalty.

So, if you don’t have enough after-tax sources of income, you should consider a series of equal periodic payments. The 72(t). Hike.

An example of the SEPP 72(t)

Some folks want to retire in their 50s. If they have a lot of money squirreled away in pre-tax retirement accounts (but no after-tax funds to do a Roth Conversion Ladder), they might consider a 72(t) SEPP.

Let’s consider a scenario in which a 50-year-old couple considers funding a gap with a 72(t) SEPP. They have a long retirement ahead and some aggressive spending goals. They will work part-time but don’t have enough income saved in the brokerage account to make it to 59 ½.

To make ends meet, they plan on doing a 72(t) SEPP from 56-60, taking out about 40k a year.

How much must they set aside in a separate IRA to afford this 40k x 5 years? It depends on their method (discussed below), but 40 x 5 = ~200k. Keep this in a separate IRA; the rest of the pre-tax retirement funds can be stored in a different IRA.

Let’s go to the planning software and see what we can find out.

Scenario

These folks have about 3M in assets and plan on spending 10k a month after taxes. They each have a part-time job, which brings in about 60k a year.

Let’s see why they might consider a 72(t).

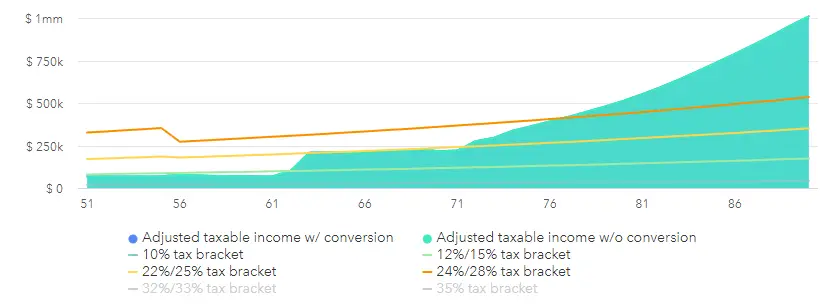

Above, we are looking at how much they pay in taxes each year relative to the tax brackets. They fill up the 12/15% bracket with income but note the jump at age 62. This is when their brokerage account runs out of money, and they start pulling from their IRA. Note that this jumps them up into the 25% tax bracket, and once RMDs start (at age 72), they rapidly go into the 28% bracket and above.

What a waste of all those lower tax brackets early on! And it is never good to decimate the brokerage account down to zero. What if you had a significant lumpy expense? Sure, you could pull money out of the IRA after 59 ½, but it is always wise to pull it out when in the lower brackets. If you spike your income with a pre-tax withdrawal, you can spike your taxes, too!

In this scenario, they cannot do Roth conversions or a Roth Ladder because they can’t afford to! Again, to pre-pay taxes, you must have an after-tax source of income. Out-of-the-box ideas for this might include a reverse mortgage, the cash value of a life insurance policy, or any other source of after-tax income. These are called buffer assets; I’ve discussed them at length previously.

Anyway, let’s look at the cashflows to see the problem in-depth.

Cashflows in a SEPP 72(t)

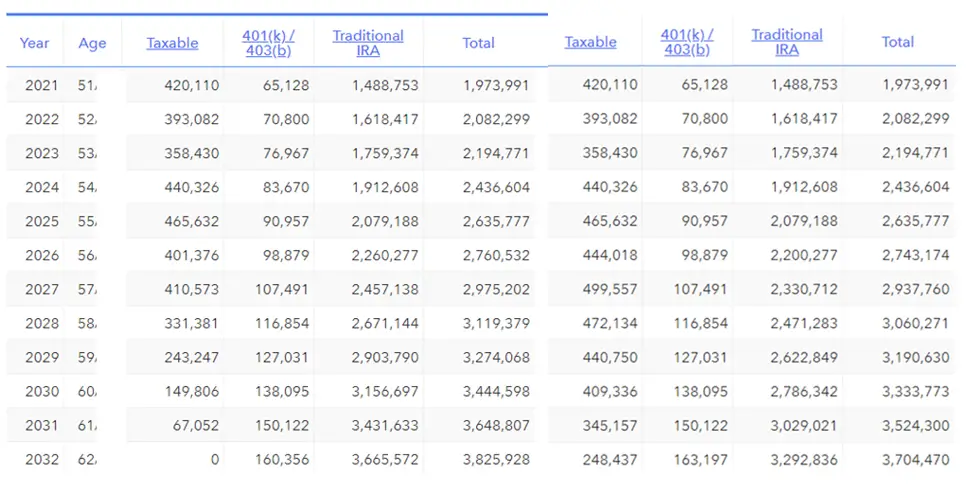

Without a 72(t) (bar above) and With a 72(t) (no bar above)

This is a busy table, but it has a lot of interesting information. Look at the column with the taxable account. You can see by the time they are 62, it is decimated.

Compare this to this taxable column further to the right to see the effect of the 72(t). If you are interested, you can see what they need to pull out of the pre-tax accounts by comparing the columns labeled 401k and see the effect of the 72(t) by comparing the IRA columns.

Finally, note that their whole nest egg is smaller at the end of the series of periodic payments. This is misleading, however, as they have already pre-paid the taxes! If we take this plan to 90 years of age, they have a larger after-tax next egg and avoid some of the higher tax brackets when RMDs strike.

The point: don’t decimate your brokerage account! Use your pre-tax money, especially if you have enough to worry about IRMAA and large RMDs pushing your taxes up. Always use your lower tax brackets. I always like saying: would you pay 15 cents on one of your dollars now to avoid paying 25 cents in the future? Yes! There is time value of money, but pre-paying taxes can effectively lower taxes and surcharges in the future.

Summary: Modeling a SEPP 72(t) in Early Retirement

A 72(t) SEPP allows penalty-free retirement account withdrawal before 59 ½. Above, it enables you to access your retirement savings and maintain an emergency account.

The amount you take out is based upon a formula, but you can fund a specific IRA with just the right amount to give you the income you need for at least five years AND until you are 59. Let’s look at the distribution options now.

Distribution Options for the SEPP

The 72(t) SEPP distribution options are amortization, annuitization, and required minimum distribution. Each will give a slightly different annual distribution amount. Honestly, it is not worth trying to determine the differences between the three. Use an online 72(t) calculator and plug and play.

For posterity, here they are:

The Amortization Method

Annual distribution is the same each year. It’s determined by life expectancy and a chosen interest rate (federal mid-term rate). As of 2022, you can use a 5% minimum interest rate to increase your SEPP payment in early retirement.

The Annuitization Method

Distribution is the same for each, just as above. It also uses life expectancy but a different interest rate (IRS single life annuity table). It is essentially the same as the first method. Also, in 2022, you can use the 5% minimum interest rate to increase your SEPP in early retirement.

Required Minimum Distribution and 72(t) SEPP

With the RMD method, you recalculate the distribution amount yearly. The amount is based on life expectancy. With this method, you start with much smaller payments, but they may increase over time. There is no effect with this method and the new interest rate in 2022.

Downsides of 72(t) SEPP

You are locked in once you start a substantially equal periodic payment plan.

You must continue for at least five years until you are 59. It is inflexible. You can only switch to the RMD from another method once during the plan. If you start with another method, there is no switching.

Don’t blow it up. If you do, all penalties and interest will be due. Take exactly what you should every year. Don’t add to the IRA or take additional withdrawals.

72(t) SEPP online Calculator

Instead of doing the math yourself, google SEPP online calculator, and you will find several options. I like CalcXML and the calculator by Bankrate.

And make sure you know what you are doing. Let’s examine what the IRS says about 72(t) SEPPs.

When Should You Take a SEPP 72(t)?

If you have an income gap and need pre-tax money, maybe consider a 72(t) SEPP! Yes, you are pulling money out of a tax-protected space, but you put it there first to use it in retirement!

Also, it pays to have a tax plan during your early retirement. For instance, if you want to qualify for ACA premium tax credits, keep a watchful eye on your MAGI to avoid losing the credits. What is essential is to have a plan. That is what early retirement is all about!

72(t) vs. a Roth Conversion Ladder

Why not do a 5-year Roth Conversion Ladder?

Folks get a series of partial Roth conversions and the Roth Conversions Ladder confused. Partial Roth conversions optimize your tax diversification by filling up your lower tax brackets during the tax planning window before Required Minimum Distributions drive you into high tax brackets.

A Roth Conversions Ladder, on the other hand, is a way around the 10% penalty on IRA withdrawals before 59.5 years of age. Here, you convert the money you need in 5 years to a Roth, pay the taxes, and then plan to spend the money in five years. The five years comes from one of the “5-Year Roth Rules,” specifically the one devoted to the seasoning of the Roth. This rule is intended to prevent the “workaround” of converting money to a Roth and then taking that money out penalty-free. There is a 10% penalty on Roth conversions that are not five years old until you are 59.5.