Asset Drawdown Strategy in Retirement

What is the optimal withdrawal strategy for a Retirement Portfolio?

You have your portfolio, sure—your stocks and bonds. But what is your retirement strategy for asset withdrawals, and how does that help mitigate the known risks in retirement?

Which asset should you access (and when) to reduce taxes and improve overall retirement security?

This is important as we all have different sources of retirement income. For example, most of us have social security, pre-tax retirement plans, and home equity, while fewer have pensions or annuities.

Let’s look at withdrawal strategies in retirement designed to minimize taxes and maximize income. Then, we will discuss some features of various assets that affect how you manage your retirement withdrawals.

Asset Withdrawal Plan in Retirement

People don’t use the 4% safe withdrawal rate. That is not how asset withdrawal strategies in retirement work!

Retirement income is lumpy! You access different assets at different times with various distribution schedules. For example, you might have a 457, then Social Security starts, then RMDs. So, we all have a different mix of income sources.

In addition, of course, spending is lumpy! Expenses differ over the years. You may be able to choose when you want to make a major purchase, such as a new car, but roofs blow off and need to be replaced at a more random interval. As a retirement strategy, the 4% rule is fiction.

So, what does the asset withdrawal percentage look like if you don’t pull 4% from your portfolio?

Order of Withdrawals in Retirement

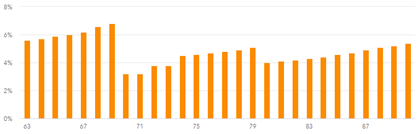

Figure 1 (Withdrawal Percentage in Retirement)

Above, you can see the withdrawal rate from this retirement withdrawal strategy. You start close to 6% and increase until social security starts at age 70.

Then, it drops off with social security and gradually increases over time.

At age 80, the definitive source of retirement income (in this case, a QLAC) kicks in.

Instead of being 4% and increasing with inflation, the withdrawal percentage varies depending on when your assets hit. This is because a strategic retirement withdrawal plan considers different income sources. You have, after all, different assets in your retirement quiver.

These assets are held in different types of accounts, such as brokerage accounts, pre-tax retirement accounts, and after-tax Roth accounts.

So, which account do you take your income from?

Optimal Withdrawal Sequencing: Account Selection

In general, the retirement strategy for withdrawal sequencing follows a staged approach. Most commonly, you spend from a brokerage account and then tax-deferred money. Then, finally, utilize tax-free (Roth) assets.

This sequence is an optimal retirement strategy as it allows tax-sheltered accounts to grow while spending down the taxable accounts. Spending taxable money first decreases taxes (via less tax drag) because as you spend it down, there is less to tax!

However, and importantly, you must withdraw enough tax-deferred money to increase your standard deduction and lower tax brackets, smoothing out the total taxes you pay over retirement.

So, instead of the withdrawal sequence brokerage first, then pre-tax, tax-free, frequently withdrawing from pre-tax accounts before you are forced to do so, it makes sense. This saves your brokerage account from being decimated and, importantly, decreases the sum of total taxes you pay over your lifetime.

Let’s look at this now.

Optimal Withdrawal Strategy: Using Pre-Tax Accounts to Fill in Lower Tax Brackets

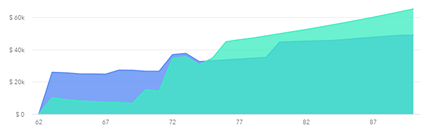

Figure 2 (Scenarios representing taxes paid with and without accessing your pre-tax accounts)

Above, you can see two different scenarios.

You don’t access your pre-tax account during your Tax Planning Window. This leads to a large pre-tax account and higher taxes down the line. In addition, once you are out of funds in your brokerage account, you are forced to liquidate your pre-tax account and pay more in taxes. Also, you are not filling up your lower tax brackets, leading to higher taxes.

Conversely, in blue, you take withdrawals from your pre-tax accounts during your tax planning window. Again, this lowers your overall lifetime taxes.

Taking your pre-tax money during your tax planning window allows you to utilize your lower tax brackets and save on taxes in the long run.

Tax Brackets and Asset Withdrawal Strategies

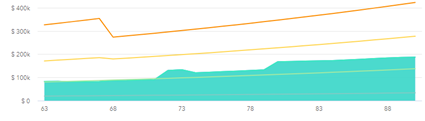

Figure 3 (Tax brackets and withdrawal strategies)

Above, you can see that we are taking out pre-tax money during our tax planning window to fill the lower tax brackets.

Specifically, we have filled in the income using the 10 and 12/15% tax brackets (in addition to the standard deduction). This lowers our overall tax bill, as future Required Minimum Distributions are smaller and don’t force distributions into higher tax brackets.

Unfortunately, there is still enough income to force part above the 12/15% tax bracket. Every withdrawal plan will differ depending on your assets and the order in which you sequence them.

Before we move on, let me clarify that the above fictional situation concerns folks needing their pre-tax retirement account. Their plan does not call for partial Roth conversions.

Not everyone has the same withdrawal strategies in retirement.

What are some of the retirement income sources that we need to consider?

Other Sources of Income

Some people have other sources of income.

Life Insurance

- Permanent life insurance for the death benefit. Indications for a permanent death benefit are considered appropriate uses of these complex and expensive products.

- Permanent life insurance for the cash value. These are less useful products, but often, you have cash value as part of your permanent life insurance, which can be an important Buffer Asset.

Home Value

- A home equity line of credit can be important in the transition period between salary and full retirement.

- HECM (home equity conversion mortgage), or a reverse mortgage, is an underutilized product. Despite the stigma, these can significantly affect retirement income planning.

- Don’t forget the value of cash-flowing rental real estate in the retirement plan. This can be an important bond-like part of your income stream in retirement.

Traditional Pensions

- It is important to decide on a lump sum or income stream (annuitization) depending on the internal rate of return offered. This is relatively straightforward math but important! If you have a pension, consider it important as the “third leg” of the retirement stool (Social Security, Pension, and Stock/Bonds)

- Single-life or survivor benefits are an important consideration.

- Traditional pensions are becoming rare as employers switch from Direct Benefit plans to Direct Contribution plans where the employee takes on the investment risk. If you have a pension, consider it gold.

Social Security

- Widow’s tax penalty is an important consideration. The higher income earner should almost always delay taking social security for as long as possible, up until 70. This is to establish as many delayed claiming credits as possible and provide the larger of the two checks for the Widow/Widower

- Longevity insurance as the payments never stop.

- Inflation protection through COLA adjustments. These are not inflated at true expenses for retirees but are important nonetheless.

This is not an exhaustive list of other sources of income, but it is a good start. What is on the other side of product allocation? The stock and bond market

Summary: Optimal Withdrawal Strategies for Retirement Income Portfolios

So, what have we learned?

An optimal Withdrawal Strategy involves turning assets into income while mitigating known risks. You get income from your portfolio and control risk with your product allocation.

Use your various products and other assets in a cohesive retirement withdrawal strategy to secure retirement.