Bond Alternatives

People have way too much cash right now. Yet, some fear bonds after what happened in 2022.

You need safer assets in your portfolio once you have passed the accumulation phase. Cash has poor long-term returns and is not a good diversifier for stocks. Of course, you need some cash (1-5 years’ worth of expenses in retirement), but too much cash is not a good thing.

Bond alternatives are an interesting consideration, especially now that interest rates and inflation are back. Your bond funds are paying better, but inflation evaporates lazy money.

If you have de-risked from your accumulation portfolio, you likely have a lot of money invested in bonds. Are there any alternatives to bond funds worth considering?

As an investment class, fixed income includes bonds, cash, and other assets. What are the options for fixed-income investing, and what are the best bond alternatives?

Why Bonds in Your Portfolio?

Before we begin, why do you have bonds in your portfolio?

Bonds do three things:

- Ballast- They provide ballast to the portfolio price stability. Most of the time, you expect a return of your principal at the end of the term

- Income- Bonds pay out twice a year until maturity. Interest rates are better than the last decade, which makes the income aspect of bonds interesting again (and asset location becomes important, too)

- Diversification- Bonds are less correlated than other asset classes with equities. When the stock market takes a hit, bonds (especially treasuries) often increase in price, which can offset the losses depending on your asset allocation

So, what are the two best kinds of bonds to own?

In general, I argue income is not necessary from your retirement portfolio; it is total return that is most important. Let’s not get into the discussion about yield vs. total return too much here. Suffice it to say that, for the most part, they are two sides of the same coin.

Focusing on yield, however, can lead to yield chasing. Chasing yield implies taking on more risk than you realize because you believe you need to create income with your portfolio. This is not the kind of bond alternative I want!

Don’t chase risk! Take risks in your risky assets, and be safe with your safe assets!

Bonds are not for yield; they are for protection.

Let’s transition now and discuss the basics of fixed income. What are the best Bond Fund Alternatives?

Best Bond Alternatives

So, what should you do if you are not interested in chasing yield but want the other benefits of fixed income? Remember, diversification through decreased correlation with the stock market and ballast to limit portfolio losses is the name of the game.

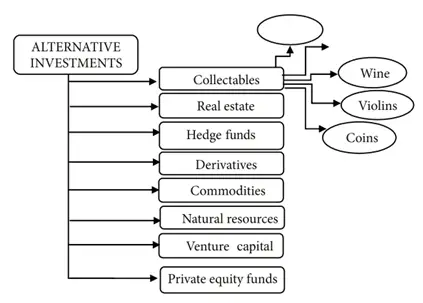

Above, you can see one view of the alternative investment world, from which we can pick the best bond alternatives. Many above are stock-equivalents. What are bond equivalents and, thus a possible best bond alternative?

What are the best bond alternatives? Consider real estate, insurance products, buffered ETFs, and miscellaneous ideas (Ag and wine).

Real Estate as Bond Fund Alternatives

First, if you owe money via a mortgage, paying your mortgage off may be the best bond alternative out there!

This is because debt is like a negative bond. As you pay off debt, you increase your exposure to bonds. Another way to say this is that if you own equities yet are in debt, you are using leverage to buy those equities. You may have more risk than you think!

REITs are another alternative to bonds. REITs pay more income than bonds but tend to act like equities and be very volatile when the market is volatile. As a result, most folks consider REITs part of their equity allocation, though you could include it as your real estate allocation or even as a type of bond alternative.

Real estate can also be a bond alternative through active or passive investments. Again, this is a broad subject. Entire websites are devoted to delving into the intricacies of real estate as an alternative investment.

Insurance Products as Bond Fund Alternatives

Insurance products offer risk pooling and are a strong consideration as a bond alternative. In addition, you can choose from life insurance and annuities.

Permanent Life Insurance

There are many different types of permanent life insurance. You should probably avoid these complicated and expensive products unless you have a specific need for permanent life insurance.

What are your options?

Whole Life Insurance

Whole Life is the best insurance option as a bond alternative. This is because Whole Life is truly non-correlated with stock market returns. Though the return on investment may be low, there is a guaranteed return on whole life and the ability to make extra returns through paid-up additions and dividends on the mutual company. If you seek diversification from stocks and bonds (and you require permanent life insurance), explore options in Whole Life insurance.

Universal Life

Universal Life is NOT as good of a bond alternative as Whole Life. This is because, first off, variable universal life invests in equities. Sure, there are “guaranteed” returns in your fictional account that may be tied to income riders, but that gets my head spinning with complexity.

Next, Fixed Indexed products depend on fixed income for the floor. Why not just own the fixed income yourself? Options on equity returns allow for the “extra” return that salesmen pitch. Well, if interest rates are low, there is not much extra to pay for the options, so expect caps and spreads (which can be changed at any time by the insurance company) to go down with decreasing interest rates. If you invest in a Fixed Iandife insurance product, you might as well use a structured product.

Structured Products

Structured Products are complicated and should not be used as a hedge. These are not good alternatives to fixed income. Speaking of complexity, try actually to understand one of these products.

Annuities as Bond Alternatives

Annuities are strong contenders as fixed-income alternatives. But, unfortunately, there are many different types!

SPIAs

Single Premium Immediate Annuities can provide floor income, obviating the need for bonds. As a result, they are a strong contender as a bond alternative.

DIAs

Deferred income Annuities offer longevity protection. Consider a QLAC if you have a large IRA. Otherwise, annuities are affected by interest rates, so DIAs are not screaming deals right now.

MYGA

Multi-Year Guaranteed Annuities are also interesting. If you are considering a bond ladder, consider MYGAs as rungs in your ladder. I think more traditional DIY investors should get to know MYGAs. These products are not sold to you; you have to go out looking for one to buy. For the money you need back in a few years, consider a MYGA instead of leaving the money instead of a high-yield savings account. Of course, you must be 60 to avoid a 10% penalty for “early withdrawal” from these products.

FIAs

Fixed InFixed-indexed annuities are a decent alternative to bonds. However, buyers should be prepared to spend hours understanding these complicated and expensive products.

RILAs

The newest fancy expensive annuity on the block, are you being sold a RILA Annuity? If so, make sure you understand how similar this is to a structured product and that you can get this without the annuity wrapper with a buffered ETF.

VAs

Variable Annuities are garbage and should not be considered as bond alternatives. There, I said it.

ETCs

Other insurance products, such as viatical settlements, reinsurance, etc., are possible fixed-income alternatives. If you want those, be ready to deal with risk with a side of illiquidity.

Pensions are the Best Bond Alterative

Pensions are a great alternative to bonds. If you have a pension, you can view that as part of your floor expenses and reduce your bond exposure accordingly.

Social Security

Social Security is perhaps the best bond alternative. Understand how to Maximize your Social Security and have a guaranteed, lifelong income better than any fixed-income alternative.

Best Alternative to Bonds

The best bond alternative– have you heard of structured ETFs? Check them out. With all the advantages of FIA, RILAs, or FILAs without the annuity chassis, structured ETFs are the best bond alternative today.

If you are looking for principal protection and bond-like returns, buffered ETFs may be the way to go.

Conclusion – Alternatives to Bonds

So, what are the best alternatives to bonds?

There is nothing equivalent to a good asset allocation for retirement. So when you have won the game, go conservative.

If you must invest in alternatives to bonds, remember not to reach for yield. The point of fixed income is stability and diversification. Don’t become mired in the mirage of income!

Real estate, managed futures, income annuities, and Whole Life insurance might be your best bet for uncorrelated returns. Of course, farmland and wine are exciting possibilities. The best bond alternatives, however, are buffered ETFs.

Never forget about pensions and social security, which are bond alternative gold.